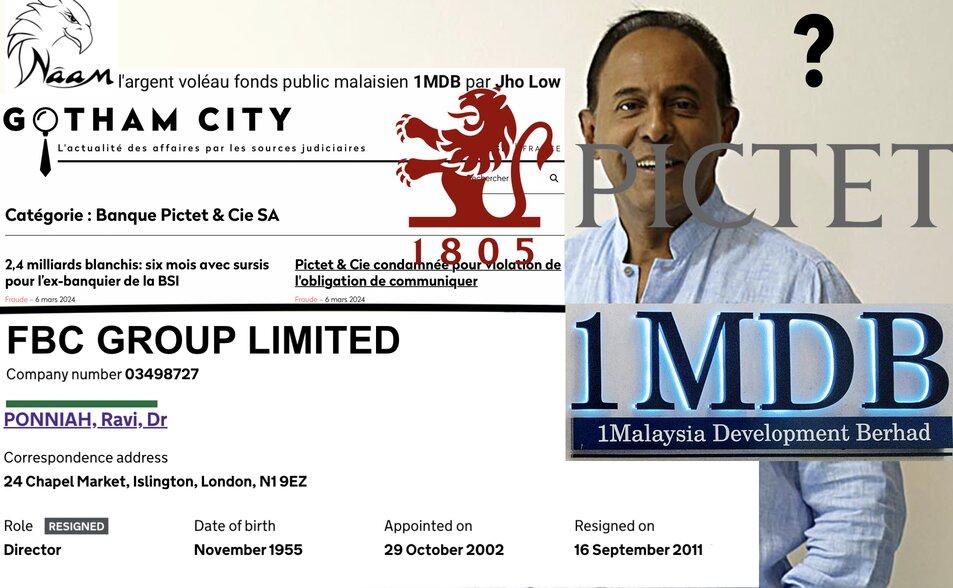

Yet another case of ‘banking blindness’ has emerged involving the transfer of 1MDB stolen money with the recently reported enforcement by the Swiss Federal Department of Finance of a CH40,000 (RM213,572) penalty against Pictet & Cie.

The private bank was penalised for deciding against reporting suspicious activity through an account in the name of a wealthy Malaysian, one Renganathan (aka Ravi) Ponniah, which later turned out to have involved money purloined from 1MDB.

Ponniah, who is also registered as a British citizen in filings in the UK’s Companies House, has emerged as a substantial businessman in Malaysia with holdings in resort hotels and businesses in Langkawi.

Promotional material does not hold back on extolling his virtues as a doctor who has branched into tourism through his Naam Group of companies. Malaysian Tatler called him:

“a popular face in the medical fraternity. With a young but successful premiere water sports and leisure company rapidly gaining attention not just in the country but also outside its borders” [Malaysian Tatler Jan 2015].

That 2015 article went on to explain that Ponniah set up the enterprise three years previously; therefore around 2011, the same year a transaction highlighted by the Swiss investigation took place. This was a $2.35 million transfer into Mr Ponniah’s Pictet & Cie account from a mysterious off-shore company that is now familiar to 1MDB watchers, Alsen Chance.

BVI registered Alsen Chance, with a bank account in Singapore, was a company managed by Jho Low’s sidekick Eric Tan which laundered funds plundered from 1MDB. Just last month 1MDB liquidators sought to put the company along with others into receivership to return its assets.

It was the exposure of Alsen Chance in 2015 that led the Swiss authorities to look into this particular payment and to question Pictet & Cie about their client and his account.

However, according to the Swiss investigative website Gotham City, the financial authorities were to discover that the bank had already begun investigations into this particular client thanks to previous revelations by Sarawak Report into the FBC Media scandal, also involving Najib Razak as well as the former Sarawak dictator, Abdul Taib Mahmud.

FBC media was a corrupted western PR company run by an ex-Wall Street Journal writer, the American Alan Freidman based in London.

In 2011 Sarawak Report found itself the target of a USD$5 million contract awarded to FBC Media by Taib Mahmud to discredit the website and its editor, Clare Rewcastle Brown, in order to undermine our revelations about corruption in Sarawak.

Najib Razak had likewise commissioned over RM28 million worth of PR services from FBC in both 2010 and 2011 in return for services that included promotional TV programmes posing as current affairs on BBC World, CNN and CNBC. This was a direct violation of broadcasting regulations by FBC’s programme production arm.

The Sarawak Report investigation revealed that the Malaysian prime minister was just one of numerous world leaders with image problems who were paying FBC tens of millions of dollars to perform similar deceptions causing the company to fold as damning reports piled in from media regulators.

Ponniah was a shareholder and director of FBC Media which the Swiss ruling makes clear Pictet & Cie bank was well aware of. as narrated by Gotham City:

“This West Malaysian businessman and British resident – whose full name is Renganathan Ponniah – became a client of the bank in 2006. At the time, his fortune was estimated at around twenty million dollars, of which he wished to deposit five million with the Geneva-based private bank.

To explain the origin of his fortune, Ravi Ponniah claimed to own a prestigious clinic in London specializing in iridology, a pseudo-medicine supposedly capable of detecting illness by observing the iris.

The entrepreneur also claimed to be a “business provider in Asia”, notably on behalf of the British documentary production company FBC Media. Pictet & Cie’s compliance department validated the file, without seeing any “increased risks”.

In the course of the relationship, the compliance department nevertheless expressed the wish to “get to know this atypical client better”. A report is commissioned from the British intelligence firm Proximal Consulting.

The detectives soon discovered that the famous clinic was a “modest stall” on the first floor of a stone building in a working-class London suburb. It is inactive. [translation]

Despite this concerning discovery the bank had decided to take no action on the basis ‘no negative information‘ had been found. “We have done our job” concluded one internal email.

Yet the Alien Chance payment in 2011, apparently relating to payments linked to Ponniah’s activities as a “business introducer” for the soon notorious FBC Media, did spur the bank to action.

“At one of its meetings in December 2012, Pictet & Cie’s due diligence committee decided to recommend that its embarrassing client Ravi Ponniah choose another Swiss banker. The latter complied, transferring his assets to VP Bank (Schweiz) AG”

explains the Gotham City report. However, despite these actions Pictet & Cie notably decided against reporting the matter to the Money Laundering Reporting Office (MROS) at their subsequent meeting on January 24, 2013.

In June 2018, the Swiss finance regulator FINMA found that Pictet had “seriously breached its duties of diligence with regard to the fight against money laundering” as a result.

Yet, to their mortification, the Swiss Federal Prosecutor’s Office was unable to discover who at the bank made these decisions, owing to the fact that the minutes of the meeting did not record who was present or who even took those minutes.

Yet the dereliction was clear, according to the ruling, since the bank failed to alert the authorities “despite contradictory explanations” from its client as to the origin of his funds. The “the obligation to communicate does not cease with the end of the relationship”.

The authorities have therefore fined the bank in lieu of the personnel responsible who have never been identified. In the process, Malaysians have learned a little more about those who profited from 1MDB.

Sarawak Report is not aware of any attempt to recover the money.

Meanwhile, SR has invited Ravi Ponniah/ Naam Group to respond to the reports and explain why 1MDB money was paid through Alsen Chance into his private bank account in Switzerland, ostensibly for services provided by FBC Media in 2011.

He has not immediately responded. However, UK Companies House reports signal that he resigned from the group in September 2011 one month after Sarawak Report broke the scandal over FBC’s conflicted contracts.

Acting as FBC Media’s agent in Malaysia at the time was the ex-APCO employee Paul Stadlen, who later moved to become Najib’s chief communications advisor during the 1MDB scandal. It was a job from which he earned staggering amounts of money before fleeing to Israel to avoid extradition from the UK after a request from Malaysia in 2019.

The ties between Najib’s illegal thefts of money and his PR machine are therefore now established more clearly than before. Exactly what role was played by the doctor cum businessman whose major investments in Langkawi began at the time he allegedly claimed to have brokered FBC’s relations with Najib remain to be explained.

Pictet & Cie, who would appear to be unperturbed by such a minor slap on the wrist for a high earning private bank, continue to refuse to disclose which of their bankers were responsible for the decision not to communicate their suspicions and concerns to the regulators as is their duty.