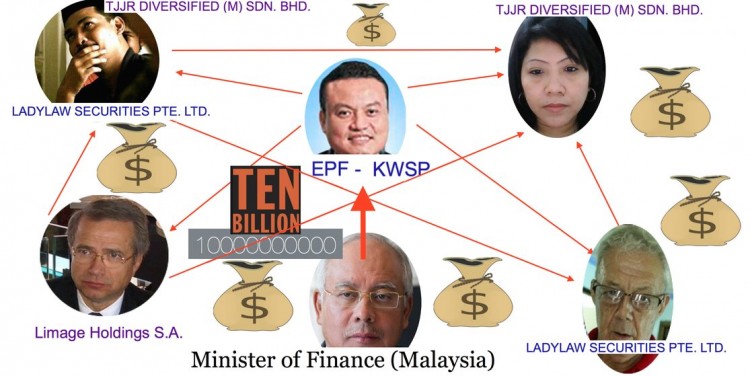

Due dilligence protocols are paramount for protecting the finances of Malaysia’s public savings institutions. Yet evidence compiled by Sarawak Report shows that Malaysia’s Minister of Finance (Prime Minister Najib Razak) defied such protocols and actively encouraged major funds under his control to pass billions of dollars to dubious secret ventures.

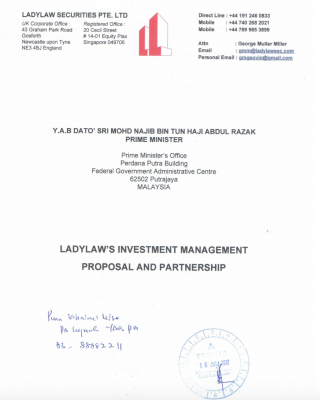

Earlier we exposed evidence showing that EPF raised an RM10 billion bond to be managed by the Luxembourg company Limage Holdings, owned by a Hungarian fraudster. We now provide further evidence that the Minister of Finance attempted to get billions more transfered into the care of a yet another little-known, unlicensed foreign entity, once again set up by a convicted fraudster, Dr George Miller of Ladylaw Securities, incorporated in Singapore.

Insiders have indicated that the motive behind these apparently reckless endeavours dating between 2012-2014 was to provide a mechanism for drawing money out of the funds for other purposes, specifically to provide political funding for Prime Minister Najib Razak and what are planned to be huge BN handouts during the upcoming election.

The funds targeted included EPF/KSWP, FELDA, FELCRA and KWAP. Each were invited to place a billion dollars into an investment proposal devised by a UK national named Dr George Miller, which pledged to acquire a portfolio of Australian and Canadian property and petroleum investments with the handed over cash and to provide a return of 250% within three years.

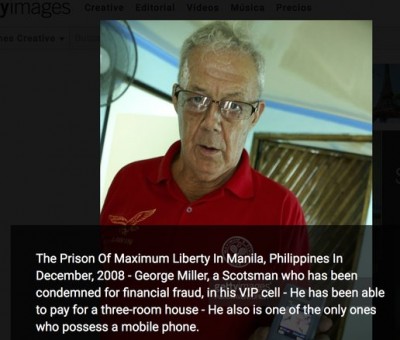

Dr George Miller had set up Singapore based Ladylaw Securities Pte. Ltd. in 2010, shortly after being released from a ten year stint at New Bilibid Maximum Security Prison in the Philippines, where he had been jailed for financial fraud. According to colleagues he later explained the reason for his incarceration was ‘unpaid hotel bills’.

Dr George Miller’s agent in Malaysia was the Ladylaw Project Coordinator, Azlan Shah Md Radzi, who was also none other than the link-man (through the Malaysian company TJJR Diversified (M) Sdn Bhd) for Limage Holdings S.A. run by another convicted foreign fraudster, Dr Gyorgy Matrai.

Limage was engaged by EPF to leverage finance from RM10.64 billion worth of bonds belonging to the fund (see previous article).

Singapore’s monetary authority (MAS) has not published Ladylaw as a licenced financial services institution and the entity was dormant until at least August 2014.

Yet as early as 2012 Dr Miller had submitted a proposal to the Ministry of Finance promoting a billion dollar investment in properties and mining concessions outside Malaysia, primarily in Australia and Canada.

The scheme involved passing the entire billion dollars to Ladylaw Securities to manage on the promise of ‘guaranteed’ high returns.

Given its profile, Ladylaw Securities would in every way appear to have been a highly undesirable partner for Malaysia’s government controlled savings funds.

Indeed, protocols demand that such funds invest only in established, tried and tested blue chip concerns and not in a ten thousand Singapore dollar company, like Ladylaw, run by an ex-con.

However, Dr George Miller, who was by then working from his UK home in Gosforth, Newcastle, was soon being entertained in negotiations with FELDA, FELCRA and EPF following a successful presentation made to the Finance Minister himself (Prime Minister Najib) in July 2012.

Following the meeting, sources say the Prime Minister encouraged Ladylaw to approach various funds under his control separately, in order to put forward the tiny outfit’s grand proposal to invest a billion dollars in property and petroleum investments.

Miller wrote to personally thank the Prime Minister for opening the door to funds such as FELDA and FELCRA in early 2014 and pointing out in bold underline that the business would be “beneficial to all parties”:

By this time an Australian local government officer in Canberra named Nic Manikis had also joined Ladylaw. He says he was introduced by friends in finance to Miller because Miller was seeking advice in building a property portfolio in Australia and was boasting of potential Malaysian investors.

Alongside his government job, Manikis says he had been permitted to pursue his own private interests in property investment and he joined Ladylaw as a director in September 2012.

He told Sarawak Report he only later learned of Miller’s jail term in the Philippines and was “uneasy” at the explanation of ‘unpaid hotel bills’. He did not know that Miller had been incarcerated for over ten years in New Bilibid maximun security prison, where there had been an attempt on his life by alleged drug gang members.

Also now involved in the Ladylaw project was another of Manikis’s financial contacts, a Canadian accountant named George Aulin, who had become a director a year earlier and had made the introduction to George Miller. In addition an Australian licenced financial advisor known to Manikis, named Malcolm Phillips, joined the team negotiating with the Malaysians.

Ladylaw obtained references from a partner at the Australian legal firm Sneddon Hall & Gallop, confirming that Ladylaw was “capable of covering all its contractual obligations” and a partner of the firm, Gerald Santucci, has confirmed to journalists that Ladylaw was involved in a number of negotiations with Malaysian funds, including EPF which has denied all knowledge of Ladylaw and claims there was never any contact between the fund and the company.

Billion Dollar Project – Pint-Sized Company

A mass of documentation seen by Sarawak Report indicates that Ladylaw Securities presented its Malaysian target funders with what would appear to be an unnecessarily risky financial package.

The company separately invited FELDA, FELCRA and EPF to hand over a billion dollars each, unecumbered, for Ladylaw to invest in largely unsecured target property portfolios, in return for a promise of a ‘guaranteed’ 250% profit within three years.

The properties mainly consisted of iconic Australian landmark buildings, which did not appear to be on the open market at the time.

Buildings targeted included major blocks such as 800 Toorak Rd in Melbourne (priced USD62.5 million); Quantas Global Headquarters, New South Wales (priced USD320 million); Farrer Place, New South Wales (USD23 m); Aviation House, Canberra (USD69 m); 23 Furzer St (USD246.5 m); Campbell Park Office, Canberra (USD121 m) and the Caroline Chisholm Centre, Canberra (USD198 m).

The combined value of these structures was projected as being USD1.04 billion, however Sarawak Report’s researches show that some were later sold for less. The presentations further suggested a series of oil and gas ventures in Canada as more ‘opportunities’ for the investment of tens of millions of dollars.

In summary Dr Miller’s ‘Private Mandate Investment’ proposal stated that Ladylaw Securities would invest in ‘Education, Health Care, Prime Real Estate, Energy Projects Oil & Gas’ using investment money of “USD1.0 billion of Lien Free & Unencumbered Cash Funds” from “EPF/KWSP, KWAP, FELDA” or, failing that, government linked companies or the private sector.

Ladylaw also made a direct proposal to Musa Aman, Sabah’s Chief Minister, in July 2013:

EXECUTIVE SUMMARY:

Deposit – USD$1 billion cash… free of encumbrances…. To invest in Australian Real Estate…. Ladylaw seeks a billion over a minimum of 13 months…guarantees 30% of its net income.. conservative best estimate 30% amounts to the sum of US$2.592billion”.

In a letter to Musa on the same day Miller acknowledged the money could be lost in the venture. “Risk cannot be entirely eradicated….” the fraudster admitted, writing from his Gosforth home address.

FELDA – Isa Samad Agreed To Invest A Billion On Najib’s Bidding

Despite the evidently dubious natue of Ladylaw Securities as a partner for Malaysia’s major public savings funds, correspondence shows that contacts within EPF, FELDA and FELCRA, apparently on the bidding of the Minister of Finance, were soon treating the approaches seriously, with various top officials even signing off on the proposed investments.

In late 2012/early 2013, a series of communications between Ladylaw, FELDA and the Ministery of Finance make clear that the PM’s Office was pressuring the fund to make a $1 billion investment in Ladylaw’s proposed property-based financial instrument.

On 24th December 2012, a memo from Ladylaw’s Project Coordinator, Azlan Shah Md Radzi, to the then Chairman of FELDA, Isa Samad, referred to a meeting a few days earlier on 20th December in the Ministry of Finance with the Private Secretary to the Minister of Finance Mohmed Puzi Sh Ali, indicting that it had been agreed FELDA should collaborate with the Ladylaw investment plan.

That memo was clearly copied to the “PM and MOF” and to the “Private Secretary MOF”, emphasiing the point that Najib was monitoring the negotiations.

Further memos in January 2013 show that the matter was then passed on by Isa Samad to Dr Suzana Idayu Wati Osman, Chief Strategy Officer at FELDA Global Ventures, for action. On 30th of that month Osman replied to Ladylaw explaining that protocol prevented Felda Global Ventures from investing in the project, because it was only allowed to invest in agricultural enterprises. However, she said the fund itself could oblige:

“…the directors of FELDA group have decided that FELDA as a government agency for managing the social economic opportunities has the mandate to invest in this portfolio as an opportunity to diversify income sources” [translated from Malay]

She went on to suggest a futher meeting on 5th March 2013 at FELDA to discuss a “total investment USD 1 Billion (RM 3.12bn)“, to be run across a term of 13 months with a “minimum annual return of 250% of the total investment”.

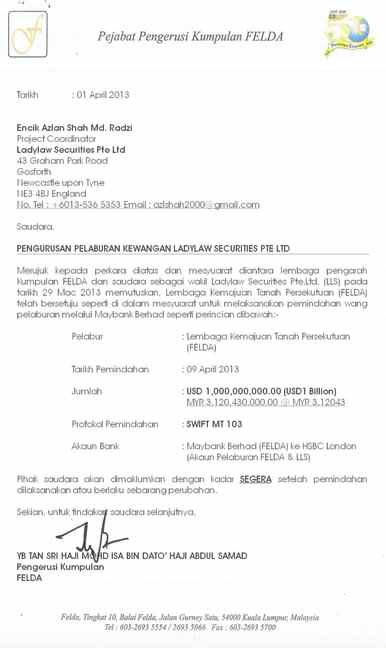

On April 1st 2013 Chairman Isa Samad duly wrote to the ex-con, Dr George Miller at Ladylaw Securities, using the then Director’s residential address in Gosforth, Newcastle, with some good news coming out of meetings in March.

FELDA had agreed, wrote the Chairman of the fund:

“…to proceed with the money transfer through Maybank as follows:

Investor – FELDA;

Transfer Date – 9th April 2013; Amount – USD1billion (RM3,120,430,000.00) ; Transfer protocol SWIFT MT 103;

Bank Acc – Maybank Bhd (FELDA) to HSBC London (investment Acc FELDA & LLS).”“Your group will be informed immediately as soon as the transfer has been processed or if there are any changes. And now over to you” [translated from Malay]

According to present Ladylaw owner and director, Nic Manikis, the deal did not in fact proceed, despite the go ahead given by the Chairman of FELDA. He told Sarawak Report that ‘internal issues’ apparently intervened.

Encouragement From Minister of Finance

Nevertheless, papers show that later in the same year negotiations were back up and running with Ladylaw’s Dr Miller, thanks largely to intervention from Najib himself.

On 12th September 2013, a senior officer in the Prime Minister’s Department, Siti Aziza Abod wrote to FELDA Chairman Isa Samad to propose a meeting with Ladylaw, as she said had been agreed with the PM’s Office.

The meeting, she explained, was for a project briefing discussion and to look through contract documents:

“Our [PM’s] office hopes that with the setting of this date we will be able to realise the collaboration between our parties to proceed where we have stalled earlier. I thank you for your coooperation”

commanded Ms Siti Abod, who at the time was acting as the head of the unit in the Prime Minister’s Office described as FLOM, servicing the ‘First Lady Of Malaysia’ Rosmah Mansor.

A week later, on 19th September, her tone was even more uncompromising in demanding cooperation from the FELDA Chairman in going ahead with the deal with Ladylaw, in an investment that was plainly being promoted by the Minister of Finance.

In Malay, Ms Siti Abod demanded that statement of readiness documents be surrendered immediately on the orders of the PM:

Dear Chairman,

FELDA HOLDINGS INVESTMENT WITH LADY LAW SECURITIES

With regards to the matter above and under the orders of the Prime Minister for the business between the Prime Minister’s Office and FELDA Holdings and YB Tan Sri as the Chairman of FELDA, please hand over the Statement of Readiness document over to the PM’s Office immediately. This is to ensure the investment project can proceed immediately and provide the investment returns.

I thank you for your cooperation.Special Officer to the PM

cc Prime Minister

It was the following March 2014 that George Miller wrote his personal letter of thanks to Najib for his support in the negotiations:

“Dear Prime Minister Najib”,

Re- Financial Investment Management Meetings FELDA Holdings Bhd, FELCRA Bhd with Ladylaw Securities…

Many thanks for your letter Jan 13 2014 regarding the above meetings. Please find copy correspondence from both parties together with my response thereto. Your support is greatly appreciated and I am looking forward to a mutually successful business outcome beneficial to all parties…”

wrote the convcited fraudster, Dr George Miller, on 3rd March 2014.

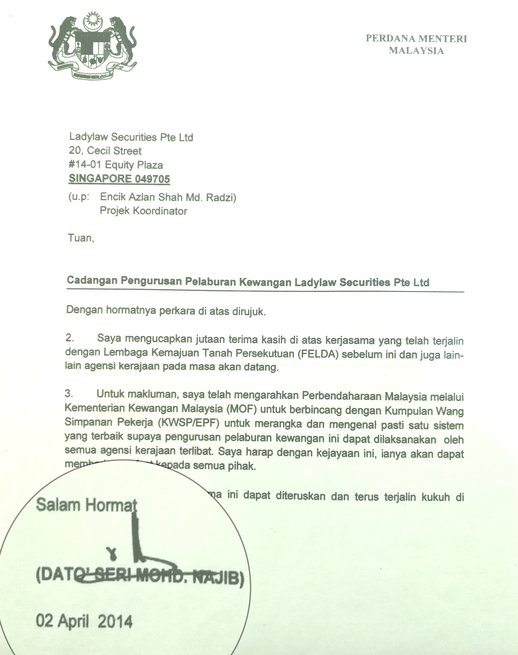

Following that note, on April 2nd 2014, Najib wrote a personally signed formal letter (in Malay) to Miller’s company, Ladylaw Securities, this time through its registered address in Singapore.

The letter was titled “Proposed Financial Investment Management of Ladylaw Securities” and clearly implies that business had been conducted and that he, as the head of government, was pressing for further engagements by other Malaysian public funds with Ladylaw’s unusual financial instrument:

“I am grateful for the cooperation with the Federal Land Development Authority (FELDA) previously and other government agencies in the future”.

“For information, I have instructed the Malaysian Treasury through the Ministry of Finance (MOF) to discuss with the Employees Provident Fund (KSWP / EPF) to formulate and identify the best system for the management of these financial investments to be implemented by all government agencies involved. I hope with this success, it will be beneficial to all. I hope that this cooperation can continue and remain strong in the future”. [Translated]

The immediate impact of the letter appears to have been to renew pressure on FELDA, which was still sitting on enormous sums of money raised from what is now widely recognised as a disastrous floatation, promoted by Najib, back in 2012.

Death Of The Fraudster Impeded Progress?

However, according to Ladylaw’s current majority owner Nic Manikis, the deals never completed. During the course of March, Dr George Miller, the financial fraudster behind Ladylaw Securities, unexpectedly died.

Najib’s letter was fielded by his now fellow director Manikis, who says he decided to take over the project and bought out the majority of Miller’s shares in Ladylaw Securities.

At first, he says, he was astonished at the easy reception he got when he contacted Ladylaw’s next target, which was EPF, in May 2014.

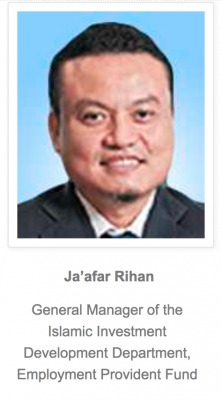

Ladylaw’s Project Coordinator (Azlan Shah Md Radzi) had introduced Manikis to a senior EPF executive, Ja’afar bin Rihan, who was receptive to a proposal written by Manikis on 29th of May suggesting that EPF should authorise Ladylaw to manage a deposit in Maybank totalling RM2.5 billion or more. Manikis has stated his terms to EPF, writing that the deposit:

“must be converted to USDs and freely transferable to LL’s USD account at Standard Chartered Bank in Singapore free of all encumbrances and lien. LL will return 6% each year for an agreed period…LL will provide a bank guarantee in USD to Maybank replacing the managed funds in Maybank following the transfer”

Manikis Couldn’t Believe His Luck Over EPF’s Welcome Reception

This proposal appeared to have gone down well with Ja’afar bin Rihan, since shortly after, on 10th June 2014 he wrote back to Manikis to advise that EFP “with the approval of its management” would consider the provision of “unencumbered funds to an amount to be agreed later to Ladylaw Securities Pte Ltd in return for a portfolio of Australian commercial properties and a share in the profits”.

“I couldn’t believe my luck” Manikis has recently confided to Sarawak Report.

However, this progress had only come after Manikis had made a written commitment in a letter of 28th May, in response to a requested by Ja’afar bin Rihan, to confirm that he would be willing to divert profits to a ‘special account’ owned by TJJR:

“Ladylaw hereby acknowledges paying a percentage of the profit from the financial investment management to be implemented or through EPF (Employees Provident Fund) into the TJJR Diversified (M) Sdn Bhd special account”.

In a later email on 19th June 2014 (from his personal address) Ja’afar bin Rihan explained he needed an “additional letter to our proxy (TJJR) for the special account” to be added to the updated proposal, which he was willing to put forward for a decision.

He referred Manikis to an attached draft of the required document and within hours Manikis had responded with a letter sent direct to TJJR specifying the profit sharing arrangement in greater detail and promising TJJR no less than the prospect of US$1.5 billion out of the EPF deal:

“..Ladylaw hereby acknowledges paying a percentage of the profit sharing from the Financial Property Investment to be implemented or through Employees Provident Fund (EPF) into a TJJR Diversified (M) Sdn Bhd special account within a twelve (12) month period from the date when EPF funds are deposited in Ladylaw account in Singapore.

In consideration of this Financial Property Investment facility, Ladylaw guarantee to pay (Investing Entity) Thirty Percent (30%) of its managed investment net income. On a conservative best efforts basis a thirty percent (30%) return amounts to the sum of USD1.5 billion or MYR equivalent…..” [bold added]

Nic Manikis has confirmed that copies seen by Sarawak Report of this correspondence are genuine and that he wrote the letter of 19th of June in good faith.

Once these understandings were in place Ja’afar bin Rihan invited the tiny team from Ladylaw to present their project proposal for their billion dollar property scheme. To ensure all this positive contact was genuinely from EPF management itself, Manikis flew himself and his entire team to KL to meet directly with Ja’afar bin Rihan in July 2014. He told Sarawak Report:

“We went into the headquarters building and were shown to meet him in his offices with his team. We then had a very professional meeting, with myself, Azlan Shah Md Radzi, George Aulin and Malcolm Phillips on our side and June and one other on his (Ja’afar’s) side”

‘June Aida Hussin’ – TJJR Diversified (M) Sdn Bhd

Manikis has explained to Sarawak Report that ‘June’ had appeared to be a close aide of Ja’afar bin Rihan during that meeting in KL, who “followed him everywhere at his side“.

Sarawak Report has identified June to be Junaidah binti Hussin (also known as June Aida Hussin), the owner and director of TJJR Diversified (M) Sdn Bhd, the company which had already been introduced into the proceedings by Ja’afar bin Rihan. Nic Manikis has confirmed our identification to be correct.

Same Cast Of Characters Connected To Limage

It was, of course, also TJJR Diversified that later engaged together with an alleged ‘Jaffar bin Raihan’ of EPF and Limage Holdings on a supposed multi-billion ringgit ‘Integrated Medical Cities Project’ (see previous articles).

Junaidah’s colleague, the Managing Director/CEO of TJJR Diversified is also none other than Ladylaw’s Project Coordinator, Azlan Shah Md Radzi, who also attended the meeting.

When queried about Azlan’s dual role, Manikis told Sarawak Report that he had not been aware that his own Project Coordinator was also linked to TJJR, which he condemned as a conflict of interest.

At the July 2014 meeting, says Manikis, Ja’afar had indicated that it would not be possible for EPF to invest directly in the billion dollar project, but that the fund would be able to do it indirectly through TJJR Diversified. ‘June Aida’ Hussin was subsequently copied in on correspondence between the parties. As Manikis explained to Sarawak Report:

“He said, in the end we can put it [the deal] through, but we can’t do it directly, you need to deal with June. I said, if that’s how it’s done, as long as there is integrity and transparency, OK”

Manikis now believes he may have been misled about the nature of the planned transaction from the Malaysian side, however he says the matter never got beyond early stages of an agreement, because EPF never produced the money. He told Sarawak Report last week that he is now relieved the negotiations started to wane.

However, this was not before Ja’afar had started to put forward an alternative proposal, late 2014/ early 2015, says Manikis, relating to a ‘Medical Centre Project’. “Ja’afar wondered if that was another way of getting funds to Ladylaw. I couldn’t see how that worked, I didn’t understand that”, Manikis has told Sarawak Report.

After that point Manikis says EPF stopped coming back to Ladylaw. Manikis suspects his failure to understand the direction of the negotiations may have played a role:

“I had made it clear to all and sundry that our dealings would be transparent and above board…..long worked for reputations to protect ….. so here we are…. no cigar”

Indeed, from early 2015 papers seen by Sarawak Report indicate that the focus of activity for TJJR and its contact at EPF, ‘Jaffar bin Raihan’ had moved to concentrate on working with the new Integrated Medical Cities project together with Limage Holdings run by fraudster Georgy Matrai.

However, EPF has issued statements to say no one at the fund has heard of Matrai or had any dealings with Limage. Dr Matrai has not responded to emails.

Yet, Sarawak Report has been informed that Matrai has spent a considerable amount of time in KL over the past year negotiating the deal with EPF and TJJR Diversified. Indeed his wife Michelle Uriate Matrai, posted on Instagram that the American couple were in the Malaysian capital and the top Fullerton Hotel in Singapore in the course of 2017.

Legal Action Looms

EPF has now issued a statement to say that neither EPF nor its executive Ja’afar bin Rihan have heard of or met either with Ladylaw and its directors or with Limage’s Gyorgy Matrai.

Following a number of legal threats and interchanges over the past weeks, Sarawak Report also understands that Ja’afar bin Rihan recently reported to the police that he believes he is the victim of a series of forged documents, including the notarised indemnity form he apparently signed to Limage Holdings for RM10.64 billion in EPF bonds under the spelling of Jaffar bin Raihan, but using the correct identity card for Ja’afar bin Rihan.

Meanwhile, Manikis has himself confirmed that he has been subject to legal action from a senior political figure in Malaysia relating to the negotiations that EPF and Ja’afar bin Rihan claim never took place.

The politician, who is senior in UMNO, has claimed that he coordinated the attempts to raise investment via EPF and the other funds and had been promised 2% commission on the billion dollars raised. Manikis says the agreement refered to, which is alleged to be a joint commitment by Ladylaw and TJJR to pay the money on receipt of investment funds, is fraudulent, although he claims would have paid the commission if the money had ever been raised:

“I had not heard of [the complainant] until I received his first letter of demand through lawyers in late 2015. Then another letter of demand from him in January 2017 and again another one in early February 2018-this last time attaching a letter of appointment and notarised document with my signatures – which I had not signed….

The document attached to the letter of demand shows 2% of US$1bn which is consistent with what I was offering any broker at the time. So [the complainant] was going to collect US$20m. His letter of demand in November 2015 confined himself to just this amount however his subsequent two letters of demand in 2017 and 2018 say that he is also entitled to an additional bonus of US$5m bringing the total to US25m. No reasons were given about this in his letter….. [his] letter of demand asserts that he got the approval of the Deputy Minister of Finance to provide Ladylaw Securities with US$1bn….Just a small problem with this is that to this day Ladylaw hasn’t received any funds.

What is also strange is that … I would expect written correspondence to this effect both from Deputy Minister for Finance as well..

Manikis has now signalled he will issue counter-proceedings against the Malaysian politician, in which case more should come out in and Australian court about what exactly EPF, TJJR and Limage Holdings have been doing with Malaysia’s old age pension funds on behalf of the Minister of Finance over the past few years and months.