There were more shockwaves created by 1MDB on Tuesday with a series of coordinated announcements by Switzerland’s regulatory agency FINMA and the Monetary Authority of Singapore (MAS).

These included another banking shutdown; more arrests in Singapore; threatened arrests in Switzerland and for the first time the formal naming of Jho Low and his father in the BSI affair.

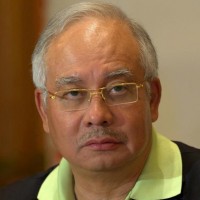

At the centre of all these charges and accusations lay the glaring, monster-payments, stolen from the Malaysian development fund and then channelled by these guilty parties into the KL bank accounts of Prime Minister Najib Razak.

The CEO of FINMA, Mark Branson, was quoted calling 1MDB:

“one of the largest cases of suspected corruption in recent times. The global financial system has been blatantly misused. Suspect financial flows in the billions have been shifted through banks of multiple nationalities and financial centers on three continents, and warning signals ignored.” [FINMA Statement]

However, as everyone in Malaysia knows, Najib’s UMNO party will claim that ‘no wrong-doing has been proven’ and that the Prime Minister ‘was not mentioned by name’ as the politically exposed person, described as having received $681 million into his bank account in March 2013 and then returned $620 million from KL to Singapore following the GE13 election (as admitted by Najib).

FINMA/ MAS Statements Decoded

As actions continue to be taken to clean up and punish the facilitators of Najib’s thefts officials have made little effort to disguise the transactions they are referring to.

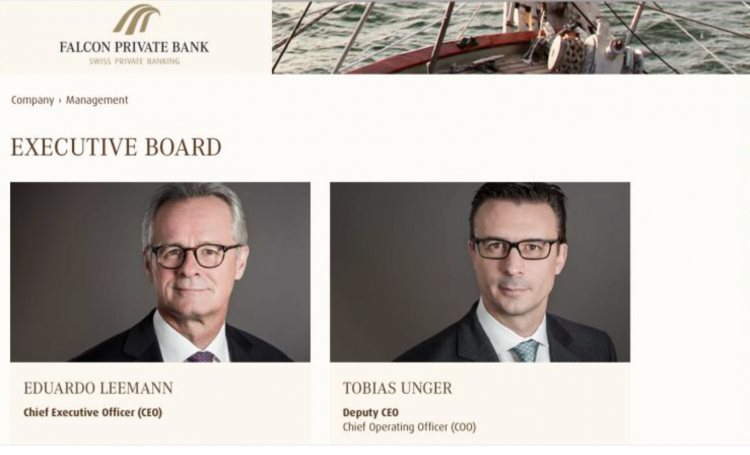

Just last month SR had predicted that the sudden resignation of Falcon Bank CEO Eduardo Leemann signalled a chaotic situation at the bank, owned by Abu Dhabi’s Aabar fund, whose own top managers had been exposed as key collaborators in Najib’s removal of billions from Malaysia in the US Department of Justice suit of July 20th.

Today MAS shut down Falcon’s Singapore branch; fined the bank US$4.3 million for 14 separate breeches of money laundering regulations and sensationally announced that the Commercial Affairs Department had arrested its Swiss Manager Jens Sturzenegger.

There had been a repeated pattern of failings when it came to due diligence and Anti-Money Laundering procedures at the bank, MAS said, not only at branch level but Head Office in Switzerland.

It was then that MAS pointed its finger directly at the focal 1MDB case in this affair and at the Prime Minister’s relationship with the two Aabar fund bosses, Chairman Khadem Al Qubaisi and CEO Mohammed Al Husseiny, both arrested in Abu Dhabi on evidence of having conspired in the looting of 1MDB.

Al Husseiny was Chairman of the Board of Falcon during the period in 2013 when $681 million was passed into Najib’s KL account and then $620 million received back again a few months after the May election. And, according to MAS:

“[Falcon’s] Head Office failed to guard against conflicts of interest when managing the account of a customer who was associated with the bank’s former Board Chairman Mohamed Ahmed Badawy Al-Husseiny. The former Chairman misled and influenced the Singapore Branch into processing the customer’s unusually large transactions despite multiple red flags.” [MAS Statement]

That customer (as any ‘idiot’ can tell, in the words of Rahman Dahlan) was Jho Low’s agent, Eric Tan, who was sending hundreds of millions of dollars to Najib Razak.

FINMA’s own parallel statement on Falcon Bank filled the gaps on MAS’s story. The Swiss said their own investigation covered the period from 2012 – 2015, identified by Sarawak Report as the period during which Aabar first assisted in the theft of billions from 1MDB, then the laundering of the money:

“Falcon Private Bank Ltd. has seriously breached money laundering regulations by failing to carry out adequate background checks into transactions and business relationships associated with Malaysian sovereign wealth fund 1MDB which were booked in Switzerland, Singapore and Hong Kong…. The breaches in question relate to business relationships and transactions in the context of the alleged corruption scandal surrounding the Malaysian sovereign wealth fund 1MDB.”

Not only has FINMA therefore fined Falcon CHF 2.5 million; banned the bank from entering into relationships with ‘foreign politically exposed persons’ for three years and threatened it will remove its banking licence at any further breech, the regulator also equally sensationally announced that it has launched ‘law enforcement proceedings against two of the bank’s former executive office holders’ back in Zurich.

Potential candidates for such a prosecution include the former CEO of the bank Eduardo Leemann, who had earlier lectured journalists that what the banking industry needed was less regulation not more:

The responsible Falcon top managers, FINMA explained, failed to take appropriate action over suspicious 1MDB transactions involving around $3.8 billion dollars, which triggered standard banking ‘red alerts’, even when asked by staff to do so [red alert points added in bold]

“Assets amounting to approximately USD 3.8 billion were transferred to accounts at Falcon and associated with the 1MDB Group during that period. These funds were generally moved on quickly. The business relationships and transactions booked in Switzerland and at Falcon’s Singapore and Hong Kong branches were unusual and involved a high level of risk for the bank both through their nature and the amounts transacted. Although management’s attention was drawn to these matters, it repeatedly failed to properly investigate the business relationships, specifically those with politically exposed persons (PEPs), and high-risk transactions; “

Again FINMA focused on the known transactions related to Najib, managed by a Malaysian agent of Jho Low, called Eric Tan.

Tan was also referred to in the US Department of Justice indictment in July as the stated beneficial owner of the Tanore Finance Corporation account in Singapore, which passed the US$ 681 million to Najib in March 2013.

According to FINMA:

“Falcon also had a client relationship with a young Malaysian businessman [ERIC TAN] with links to individuals in Malaysian government circles [JHO LOW]. The bank did not verify how this individual had been able to acquire assets of USD 135 million in an extremely short period of time or why a total of USD 1.2 billion was transferred to his accounts at a later date – a transaction which was clearly at variance with the information he had provided when opening the account. Falcon also failed to adequately investigate the commercial background to pass-through transactions amounting to USD 681 million and the repayment six months later of USD 620 million via these accounts despite conflicting evidence.”[FINMA Statement]

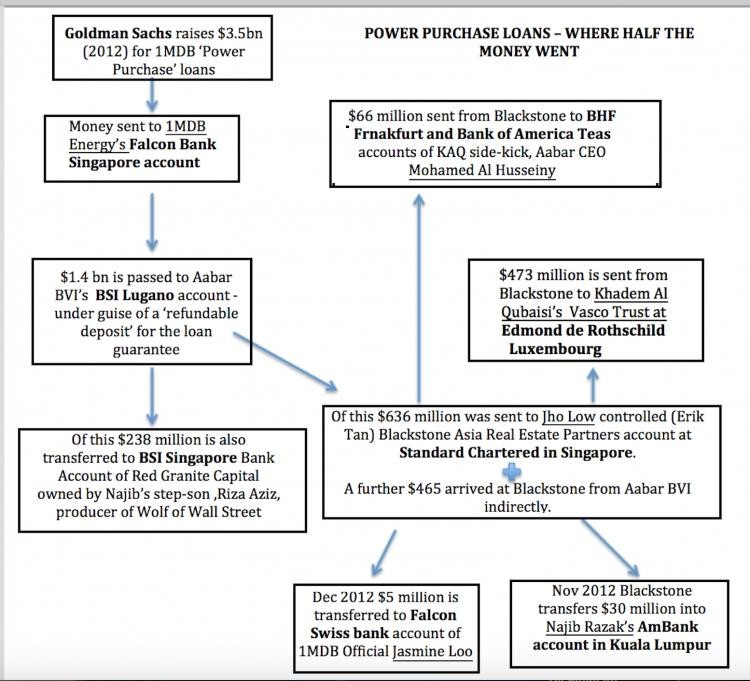

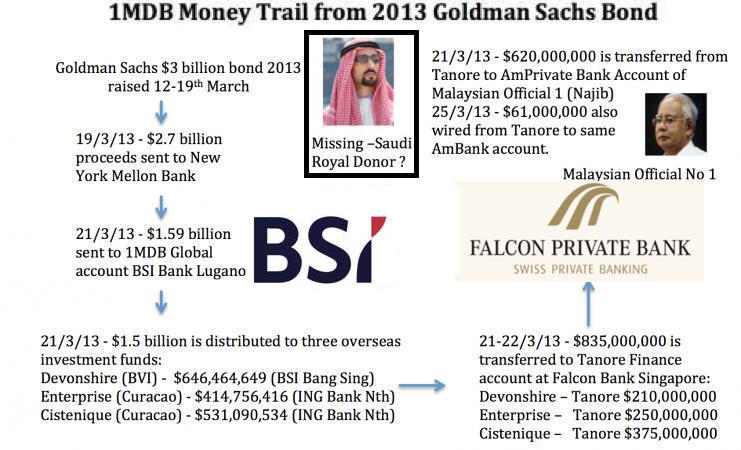

Sarawak Report has identified the transactions referred to in this case as those linked to Tanore Finance Corporation, which passed money raised by a Goldman Sachs bond issue for 1MDB raised in March 2013 straight through to Najib’s KL bank account in one single day… ready to finance UMNO expenses for the election Najib was about to announce.

The Department of Justice has already detailed how the money raised by Goldman was transferred in the course of a single day – 21st March – through a complex financial path on to Najib. From Goldman it had been transferred to New York Mellon bank, then all on the 21st March $1.5 billion was sent to first BSI Lugano (now also closed by regulators owing to breeches linked to 1MDB); then distributed amongst three off-shore investment funds; then sent to Eric Tan’s Tanore Finance Corporation account at Falcon Bank in Singapore and then finally (all on the same day) forwarded to Najib’s AmBank account in KL

Staff at lower levels in Falcon Bank immediately raised the red alert with their senior management about this huge and suspicious transaction, says FINMA. But, their rightful protests were ignored at the highest levels in the bank, purely because of pressure from the Najib’s Aabar co-conspirators on the Board.

“Falcon ..failed to adequately investigate the commercial background to pass-through transactions amounting to USD 681 million and the repayment six months later of USD 620 million via these accounts despite conflicting evidence. In this context, an internal Falcon email states: “We started this six months ago and now we have to go through with it – somehow”…. A number of bank employees expressed serious concerns to their managers about the relationship with the Malaysian businessman because of numerous suspicious factors and key questions remaining unanswered. One internal email relating to the transfer of USD 1.2 billion states: “We can’t find any reason/motivation/statement why this transaction has to pass through FPB [Falcon] and not from [Bank X] directly to the respective parties […].” Nevertheless, these internal warnings were not followed up satisfactorily. Although the bank’s decision-makers were aware of these internal concerns, they decided to carry out the transactions. The focus was always on trying to process the transactions on time. One senior manager warned the Singapore branch carrying out the transactions: “Head Office is watching you”.

The DOJ indictment has already confirmed that both the Falcon Bank ex-Board Members involved, Aabar CEO Al Husseiny and Aabar Chairman Al Qubaisi received kickbacks from the 1MDB stolen money for utilising Falcon in this way. The banks Swiss management were willing to allow it, FINMA says.

Members of the board of directors initiated the business relationships

Two representatives of the bank’s owners who were on the board of directors initiated business relationships with the 1MDB Group and with individuals from their immediate circle. The managers responsible for these relationships therefore attached great significance to them and were concerned to ensure that they operated smoothly.

According to their own statements, they assumed that the two board members represented the will of the bank’s owners as far as these relationships were concerned. Both board members pursued their own illegitimate purposes.”

Again, whilst all these parties are now facing the destruction of their careers, fines and far worse punishments, the author of the crime remains Najib Razak, protected by UMNO in KL.

Further major announcements point to Najib also

Further 1MDB related announcements the same day emphasised the criminal nature of the enterprise set up and orchestrated by Prime Minister/ Finance Minister Najib and managed through his agent Jho Taek Low.

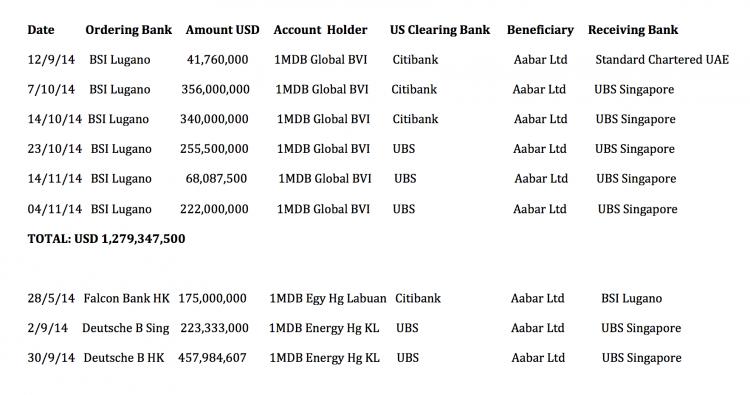

In July Sarawak Report broke the news that UBS Bank had handled major transfers for 1MDB, through an account in the name of the fake off-shore Aabar PJS Investments Limited BVI, held in Singapore.

Sarawak Report illustrated how this UBS account was used to funnel hundreds of millions of dollars in fast transfers (often the money remained for less than one day in the account) of 1MDB related money – the purpose being to fool the fund’s accountants that money had been returned from a bogus Cayman fund investment of non-existent profits from 1MDB’s original PetroSaudi deal.

The Monetary Authority of Singapore has announced that as a consequence of its negligence, apparently over this ’round-tripping”, UBS has been fined US$1.3 million for 13 breaches of MAS Notice 626:

“The inspections revealed several breaches of AML requirements and control lapses. There were deficiencies in the on-boarding of new accounts, weaknesses in corroborating the source of funds, inadequate scrutiny of customers’ transactions and activities, and failure to file timely suspicious transaction reports.

Also in the frame is the Singapore Bank, fined $10 million for ten similar breaches linked to 1MDB (Sarawak Report has yet to obtain the details).

The MAS made clear that it has yet to complete its findings on Standard Chartered Bank, which also acted as a clearing bank and receiving bank on a number of these deals and also hosted the vast Jho Low account for the bogus off-shore company Blackstone Asia Real Estate Partners, which funnelled large sums to Khadem Al Qubaisi’s Rothschild account in Luxemboug and into further kickbacks to Najib’s AmBank account, to Jasmine Loo and to Al Husseiny.

Jho Low and his Dad cited in further BSI arrests

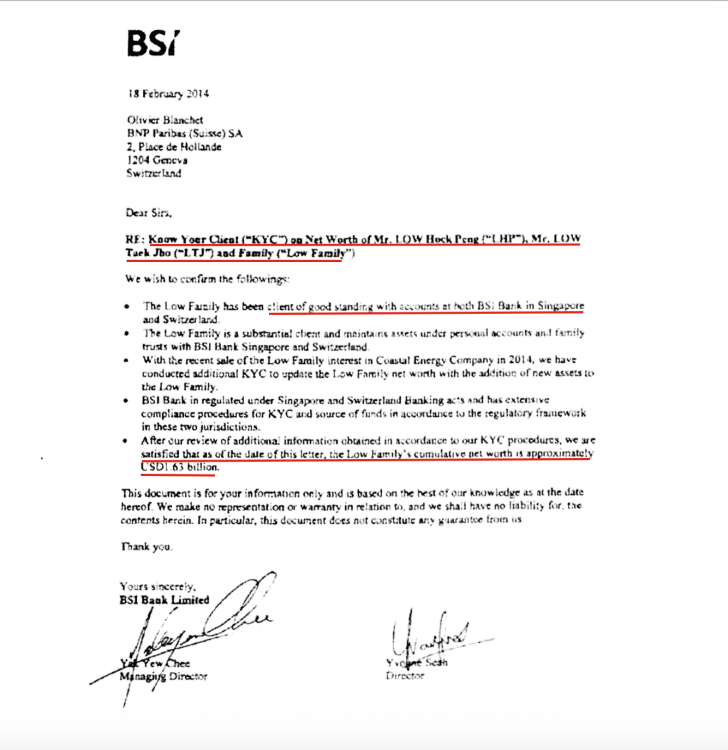

For the first time also the welter of Singapore announcements included direct referrals to the lynch-pin Jho Low and his father’s roles in the 1MDB money-laundering system as the details of two more arrests of BSI bankers were also released through the courts by the Commercial Affairs Department (CAD).

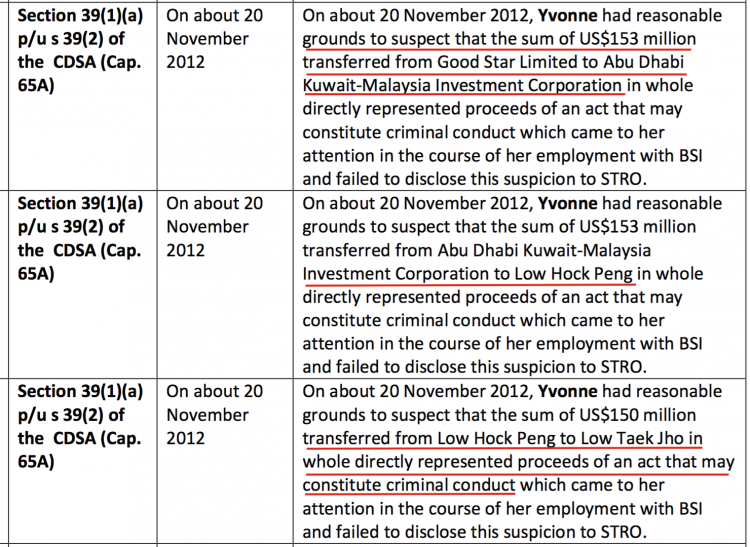

Yak Yew Chee, who has faced questioning for months and a colleague, Yvonne Seah Yew Foong were finally arrested, making the total of employees arrested from the former bank to four. They are charged with failing to alert to suspicious transactions on Low’s account and to forgery of references for Low.

The suspicious transactions related to the $700 million stolen from 1MDB’s joint venture from PetroSaudi, according to court papers. This was the money, which had been siphoned into Low’s Good Star account in RBS Coutts Zurich. Low and his father later transferred the money a number of times before using it to buy investments in the United States under the guise of ‘family’ money, according to the DOJ.

The charges against Yak and Seah relate to the transfer on Nov 2, 2012 of US$153 million from a Coutts Zurich account of Good Star, a firm Mr Low controlled, to the BSI Singapore account of Abu Dhabi-Kuwait-Malaysia Investment Corp. Three days later, the US$153 million was moved to Mr Low Hock Peng’s BSI account. On Nov 7, US$150 million was moved to another BSI account held by Mr Jho Low. And from his account, US$110 million was transferred to a Swiss account of Selune, a firm he beneficially owned. [Straits Times]

However, whilst authorities the world over are prosecuting in all directions over 1MDB’s vast web of stolen money, Najib remains in KL ‘cleared’ of all charges by his own appointed Attorney General and UMNO party stalwarts.

Much of Malaysia’s stolen money has been spent on keeping UMNO big wigs quiet, as this global scandal just grows and grows.