Sarawak Report has already identified some of the most expensive houses in Beverley Hills, San Tropez, Paris and New York, as well as a string of top Las Vegas nightclubs and a global hotel and restaurant chain, as belonging to ex-Aabar chief Khadem Al Qubaisi.

Now, as Malaysia’s 1MDB and Abu Dhabi’s Aabar funds continue to reel from enormous losses, accompanied by investigations into questionable deals involving both these sovereign wealth funds, we have identified more massive investment under his beneficial ownership in New York and elsewhere.

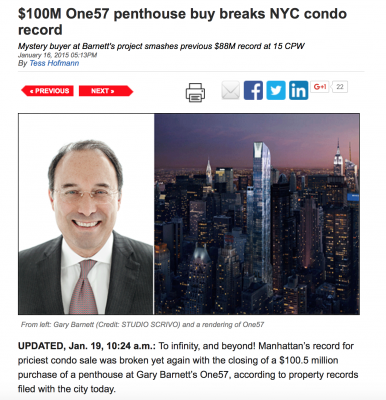

These include the most expensive real estate development in Manhatten, New York’s highest and costliest new residential tower at 157 West 57th Street, where a penthouse was recently sold for a record price, topping US$100 million for the first time.

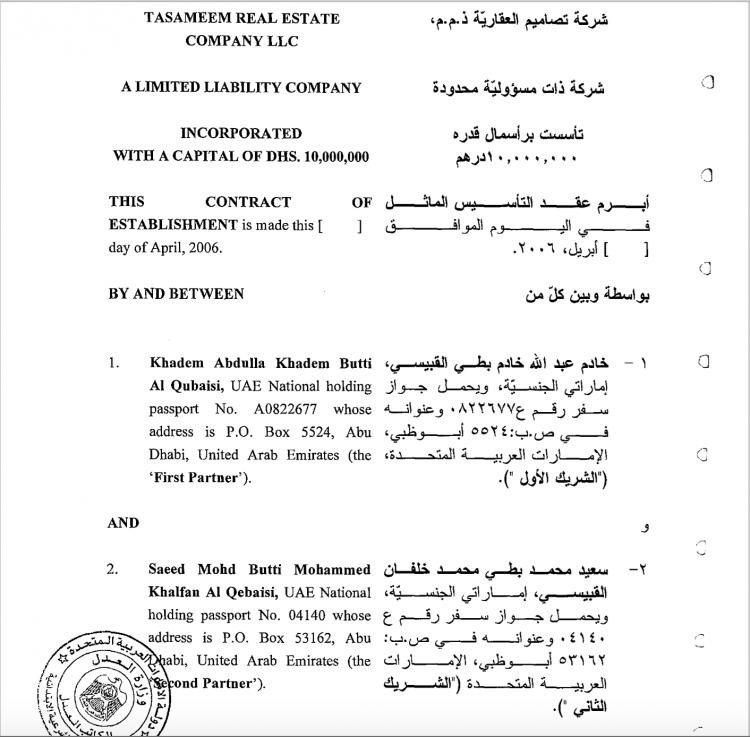

This signature development was bankrolled by Tasameem Real Estate Company LLC, a private company owned by Al Qubaisi, significantly in tandem with Aabar itself, which under the Chairmanship of Al Qubaisi moved in to provide three quarters of the lending for the project, in which Tasameem was already reported to be an investor shareholder.

The revelation, which raises immediate questions of conflict of interest, comes in the wake of the Wall Street Journal’s report this week confirming that the Swiss authorities are investigating the Aabar owned private Falcon Bank, which Al Qubaisi also controlled and which conducted the transfer of RM2.6 billion into Prime Minister Najib Razak’s personal bank account [See base for full article].

One57 West 57th is just one of a series of developments spearheaded by the property company Extell, run by New York mogul Gary Barnett, who has evolved into the city’s biggest construction magnet thanks largely to the injection of Abu Dhabi’s cash.

Meanwhile, Al Qubaisi has likewise been creating headlines in Las Vegas with his rash of nightclub acquisitions also through Tasameem, under the brand of Hakkasan. The latest venture of the expanding phenomenon is due to open in Jakarta, earning its front man, the UK businessman Neil Moffit, legendary status in the entertainment press.

The existence of such a vast private portfolio in the hands of Al Qubaisi raises clear questions over how this Abu Dhabi fund executive acquired such enormous spending power in the short period since 2008, when he rose to prominence as Sheik Mansour’s agent during the Barclays Bank bail out deal?

“Qubaisi was a very senior executive and doubtless benefitted from very large remunerations. However, he was still only a salaried executive”, explains one Abu Dhabi insider. ” He has been investing hundreds of millions of dollars, more like billions of dollars, in these investments and all in a very short period: how come?”

“Government controlled” – the public misconception behind Tasameem Real Estate Investment LLC

Al Qubaisi was, of course, sacked from all his official Abu Dhabi posts, including Chairman of Aabar and Chief Executive of the International Petroleum Investment Fund (IPIC) earlier this year, shortly after Sarawak Report exposed his unusual dealings with 1MDB – including a payment of US$20 million from the company Good Star, which is owned by the fugative Jho Low.

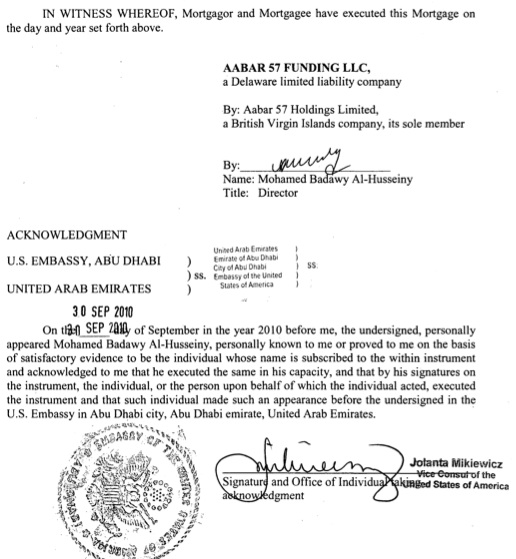

His immediate deputy Mohammed Badawy al Husseini (who claims to have personally bankrolled Najib son Riza’s film Wolf of Wall Street) has likewise been removed from all his Abu Dhabi sovereign wealth fund-related posts.

Yet, as the fortunes of 1MDB and Aabar, which were connected into billions of dollars of joint borrowing and investments, flounder, their former key officials are still burning money.

On the Malaysian side, Jho Low remains seemingly protected by the Prime Minister Najib Razak from questioning over 1MDB’s RM42 billion dollar deficit, yet has also been recorded lavishing hundreds of millions of dollars on entertainments, philanthropy and investments in the US over the past year alone.

Meanwhile, Aabar, which is a subsidiary of Abu Dhabi’s International Petroleum Investment Company, is believed to have lost some US$50 billion during the course of Al Qubaisi’s management.

One significant aspect of this questionable state of affairs has been the apparent confusion amongst various business partners as to the true ownership of Tasameem, which in turn owns the massive Hakkasan nightclub, restaurant and hotel chain as well as the New York investments and various mega-constructionss in the Middle East.

These are habitually presented as Abu Dhabi government-owned, like One57 W57th Street:

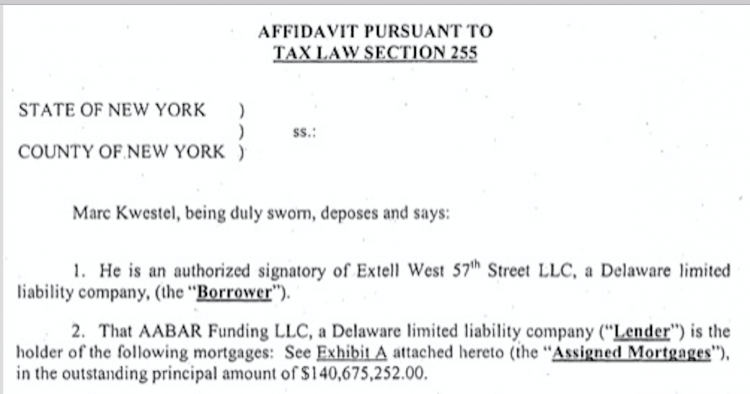

The fact that Aabar put up the money for the project is confirmed by mortgage documents signed by Al Qubaisi’s number two Mohammed al-Husseiny.

When Aabar came in to help shoulder the mortgage, Tasameem was already a shareholder, according to reports. The funds together owned 88% of the building, investing a total US£650 million with an eventual billion dollar profit made on sales. Aabar reportedly paid for three quarters of the funding, so what was its share of the project?

The Wall Street Journal, like the New York Times, also described Tasameem as an Abu Dhabi government-owned investment fund:

Mr. Barnett began assembling what would become One57 in 1998, when he bought a building on West 57th Street. .. About four years ago, he was introduced through a mutual friend to Khadem Al Qubaisi, a top executive of two major Abu Dhabi government investment funds: Aabar Investments and Tasameem.

He met Mr. Al Qubaisi in London and requested additional funds. He left with a commitment for about $250 million more. “There will be buyers,” Mr. Barnett says Mr. Al Qubaisi told him. [WSJ, Dec 2011]

Sarawak Report suggests that while there is a separate entity named Tasameem, which is the real estate arm of the Abu Dhabi Investment Authority (ADIA), this should not be confused with the Tasameem Real Estate Company LLC which is privately owned by Khadem and his partner Mohd Kalfan al Qebaisi, according the court documents produced in the United States.

Similar confusion has been spread with regard to the monster restaurant and entertainment empire that has mushroomed during the same period under the brand Hakkasan, originally the name of a London Chinese restaurant where Khadem’s boss Sheikh Mansour allegedly enjoyed a meal.

Hakkasan, which is fronted by the British businessman Neil Moffitt, has caused sensations in Las Vegas and beyond over the depth of its pockets, embarking on a global acquisition spree, which has triggered a series of court suits from rival operators.

Moffitt has played the business mogul, however the money has been invested by Tasameem. It has been generally said and understood that this enterprise also is government owned via Adia:

In fact, as Sarawak Report has already noted, whilst the nightclub focused interests of the business are in keeping with Al Qubaisi’s own well-known tastes and interests, it is a highly unlikely choice for a major investment by Abu Dhabi.

It leaves questions as to why reporters seem to have been misinformed in such a way.

The question of conflict of interest is also plainly raised with the apparent possibility that Aabar was holding the risk on projects such as One57 W 57th St, but not necessarily standing to make the major reward, which would accrue to the shareholders.

The employment of Aabar cash to back Al Qubaisi’s private business ventures appears to present a pattern. Sarawak Report’s earlier exposes have revealed court claims that Khadem originally owned the lions share of a company named Edgeworth that partly bought the loan on Europe’s most expensive Santander building in Madrid.

Al Qubaisi’s interest in Edgeworth was itself financed by a loan guaranteed by Aabar according to the court papers. He used business partners, including developer Robert Tchenguiz, to disguise his own overwhelming interest in the company (believed to be an 80% shareholding), whilst Aabar itself publicly owned the remaining 50% of the Santander loan purchased from the Royal Bank of Scotland.

Global investor

There seems no let up in the investment frenzy on the part of Tasameem and its subsidiaries, despite Khadem’s removal from his posts. In fact, the funnelling of money into entertainment and construction projects continues to attract headlines surrounding Moffitt and Extell, with less explanation surrounding the source of the financing behind them.

Hakkasan, according to the news reports and a spate of gushing articles, is dismissing all concerns about Moffitt’s apparent inexhaustible means as ‘false rumours’.

With this kind of success comes “jealousy” and “envy,” two things Moffitt is ready for and expects from the media and his competitors. And the rumors keep coming — though they are laughable to the tycoon, who really only thinks and cares about his company and the people in it… “People are infatuated with what the company does and I find that a little strange to be honest. The people that matter to me are the people in our company. They understand that the rumors are just rubbish and ill-founded by jealous people who have nothing better to do than gossip. I’m the CEO of the largest non-gaming hospitality company in this city. People like to take a pop at things like that.” [David Morris, Ask Men interview]

Meanwhile, back in Abu Dhabi Khadem’s successors at the Aabar fund are like the Swiss conducting high level enquiries and reviews into what went so wrong with its investment strategy that its assets have now reduced from US$70 billion to less than US$15 billion today.

What is inescapable is the close link with Khadem’s pal and private business partner Jho Low and Low’s own vehicle 1MDB.

One of the last actions of Qubaisi’s deputy at Aabar, Mohd Al Husseiny, before he himself was sacked, was to shoulder US$3.5 billion of 1MDB’s own debt, which the Malaysian fund had been finding impossible to finance.

The wild excesses of these two nightclubbing pals cum fund managers, Jho Low and Khadem al Qubaisi, have certainly left headaches not only in Malaysia but in one of the wealthiest Kingdoms in the Middle East.

WALL STREET JOURNAL ARTICLE BELOW

Swiss Probe of Malaysia’s 1MDB Puts Falcon Bank in Spotlight

Small Zurich-based wealth manager landed in middle of controversy around Malaysian government fund

An investigation into dealings by a Malaysian government development fund is bringing unwanted attention to a number of Swiss banks, including a small wealth manager snapped up by an Abu Dhabi investor during the financial crisis.

Swiss authorities investigating executives at Malaysia’s 1Malaysia Development Bhd., or 1MDB, are focusing on transactions tied to the public fund that were made using Zurich-based Falcon Private Bank AG, people familiar with the matter said.

The investigators have said publicly that they are probing suspected money laundering and possible corruption of foreign officials. Their probe, and others in Malaysia and Singapore, have landed Falcon in the middle of the controversy around 1MDB, which was set up to spur growth and is now caught up in allegations of political corruption.

1MDB has denied wrongdoing and said it is cooperating with investigators. A spokesman for Falcon, which hasn’t been accused of any wrongdoing, said the bank is “fully transparent and cooperative with the current investigations by various authorities and regulators.”

Falcon kept a relatively low profile for decades as a unit of U.S. insurance giant American International Group Inc.,focusing mostly on wealth management for Swiss clients. When the insurer nearly collapsed during the financial crisis in 2009, its Swiss bank was sold to an Abu Dhabi sovereign-wealth fund. The bank then became entangled in a number of transactions involving 1MDB.

The bank’s Abu Dhabi owner is International Petroleum Investment Co., or IPIC, a fund that has done business deals with 1MDB on various occasions.

In 2012, IPIC guaranteed $3.5 billion in bonds sold by a 1MDB unit to finance the purchase of some power plants.

A Malaysian government probe has found that in the following year, nearly $700 million went from an account held by an unknown owner at Falcon’s Singapore branch into an account allegedly belonging to Malaysian Prime Minister Najib Razak ahead of a close election.

The original source of the money is unclear, though the cash moved through banks, agencies and companies linked to 1MDB, according to documents reviewed by The Wall Street Journal. In August, Malaysia’s anticorruption body said the funds were a donation from the Middle East. The donor wasn’t specified. Mr. Najib has denied wrongdoing, and denies using the money for personal gain. Officials at 1MDB have denied wrongdoing and said the fund is cooperating with investigators.

In addition, a 1MDB subsidiary held an account at Falcon, which was used last year to make a payment of $175 million that appears to have gone to a unit of IPIC, according to a document viewed by The Wall Street Journal.

Experts say that 1MDB’s relationship with Falcon and other Swiss banks raises questions about why relatively small wealth managers were handling payments worth hundreds of millions of dollars for a government fund.

“It would be very odd for a government fund to even have an account with a small, private bank,” said Daniel Marovitz, who runs European operations for cross-border bank payments service provider Earthport PLC. Mr. Marovitz, who previously was a managing director in Deutsche Bank AG’s global transaction banking division, said large banks covet such clients and compete aggressively for their business.

PRIVATE PRACTICE

Malaysian state investment fund 1MDB used small private banks for billions in transactions rather than big global banks, which are typically used for transactions of this size because of their size and scale, banking experts say.

- September 2009: 1MDB uses Swiss private bank BSI SA to invest $1 billion in Saudi oil venture. Documents compiled by Malaysia’s auditor general show that $700 million of that went into an account at another private bank, Coutts International. 1MDB says all payments were proper.

- May 2012: Unit of 1MDB agrees to make an unspecified payment to a BSI account held by Abu Dhabi-based government fund International Petroleum Investment Company, which guaranteed $3.5 billion in 1MDB bonds issued to pay for power assets, according to a collaboration agreement signed by the 1MDB unit and an IPIC investment unit.

- March, 2013: Malaysian investigators say $681 million was paid via the Singapore branch of Falcon Private Bank AG from a British Virgin Islands-registered company to an account allegedly belonging to Malaysian Prime Minister Najib Razak. Mr. Najib denies wrongdoing and says he took no money for personal gain. Falcon said it can’t legally discuss client matters.

- May, 2014: A 1MDB unit uses a Hong Kong-based account at Falcon to pay $175 million to a BSI account held by IPIC, a document describing the transaction shows.

Large transactions tied to government funds or elected officials would also likely raise red flags for internal auditors, bankers and anti-money-laundering specialists say.

A Falcon spokesman said the bank is legally barred from answering questions about its clients. The spokesman said Falcon is fully independent and that “our shareholder is not involved in our daily business operations.”

A spokesman for IPIC didn’t respond to requests for comment. A representative of 1MDB also didn’t respond to a request for comment.

Switzerland’s Attorney General’s office said in August it had opened an investigation of two unidentified executives at 1MDB, and other, unidentified individuals, based on “suspicious transactions” at unnamed banks.

The following month, the Swiss authorities said they had frozen assets in unspecified Swiss banks, as part of the probe.

At least two other Swiss banks carried out multiple transactions linked to 1MDB—BSI SA, which was sold last year to BTG Pactual,and Coutts International, which was recently acquired by Geneva-based Union Bancaire Privée, according to documents viewed by The Wall Street Journal and people familiar the matter.

A spokesman for BSI declined to comment, as did a spokesman for BTG Pactual. A spokesman for Union Bancaire Privée deferred questions to a spokeswoman for Coutts, who declined to comment.

Falcon, the smallest of the Swiss banks known to be tied to 1MDB, suffered several years of losses following its purchase by IPIC, amid high costs, volatile markets and a regulatory crackdown by U.S. and European governments on secretive overseas banks accounts held by their citizens. In July, Falcon admitted to maintaining accounts for American clients who hadn’t declared them for tax purposes, according to a non prosecution agreement with the U.S. Justice Department. The bank paid a penalty of $1.8 million.

To reverse its losses, Falcon shifted its focus from recruiting clients from Switzerland and Western Europe to other regions. “Three emerging markets that go to Switzerland, still, are Eastern Europe and Russia, the Middle East and Africa,” said Falcon Deputy CEO Tobias Unger in an interview earlier this year, talking about the sources of possible clients. “The obvious strategy is to cover those three markets.”

Falcon reported turning a profit of nearly 7.5 million Swiss francs last year. Assets under management have risen from 8.7 billion francs in 2009 to 15.6 billion francs at the end of 2014.

When Falcon was still owned by AIG, nearly half of its clients were Swiss residents, while 3% came from Central and Eastern Europe and 7% came from the Middle East, Asia and Africa. Now, just 23% are Swiss residents while 20% come from Central and Eastern Europe, and 25% from the Middle East, Asia and Africa, according to the bank.