As Tim Leissner finally began his sentence at the weekend for defrauding 1MDB, Sarawak Report’s probe into the settlements around his case has prompted extraordinary revelations about assets funded by stolen Malaysian money that appear to have escaped the DOJ’s net.

Our scrutiny of the records shows that the disappearing act began with a series of complex manoeuvres executed by the banker after he saw the writing on the wall with the fall of Najib government in May 2018. As investigations closed in on him he raced to hide his ownership by putting the holding company outside the jurisdiction of the US authorities.

Given that the DOJ appears to have allowed Leissner to more or less get away with these tactics as part of a generous settlement in return for his evidence and cooperation, these assets look set to remain in the ex-Goldman Sachs banker’s hands to enjoy after he completes his meagre two year sentence.

Case records go back to Leissner’s original arrest in the United States in July 2018. They show that after the ex-Goldman Sachs banker was charged he was required to post bail. He did so by agreeing to surrender $20 million worth of shares (at their current value) in the company Celsius, which he claimed to own through a company he controlled called Nu Horizons.

A US Department of Justice filing confirms that these shares had been purchased through cash purloined from 1MDB:

“The Celsius stock that was issued to Nu Horizons was obtained using proceeds from the 1MDB bond scheme.”

[DOJ vs Russell Simmonds Case 1:23-mc-01505-MKB Document 21 Filed 12/07/23]

However, it became clear in Leissner’s subsequent trial that weeks beforehand he had officially SOLD his interest in these very shares. He did so on May 10th, the day it became clear that Najib had lost the Malaysian GE13 election and that the game was up for the 1MDB conspirators.

The sale plainly represented a ‘Plan B’ that Leissner had kept on standby and put into immediate effect during those fateful hours as Najib’s power to protect his crooked collaborators evaporated.

According to Leissner’s later court confession as a witness in the Roger Ng trial, he transferred his entire interest in his company Midas Commodities, under which he held the Celsius shares and a number of other assets, including his Beverley Hills mansion bought for $25 million, for $170 million on that day.

The ‘purchaser’ was a company named Newland Limited, incorporated in Hong Kong under the name of a Qatari businessman called Ghanim Saad M Al Saad Al-Kuwari. This was how Leissner explained his actions:

Q: “And at some point, you were going to try and transfer assets out of Kimora’s name to Ghanim bin Saad?”

[Leissner]: “Ghanim Al Saad, yes…. it was just a holding company that was going to hold these assets that I was going to transfer into it.”

Q: “...including the Keyway Pride California which owned the $25 million Beverly Hills house, to Ghanim for $170 million?”

[Leissner] ” … essentially, yes”. [Transcript Leissner testimony Roger Ng trial].

The name of Ghanim Saad has emerged during previous dealings involving Leissner and the same source of money that was later sent to Midas to purchase the various assets.

Ghanim Saad was the owner of the Century Banking Corporation in Mauritius, which Jho Low had attempted to buy in 2016 using a transfer of 156m euros from Al Mouniratyen, the Kuwaiti front company set up by the now imprisoned Sheikh Sabah Jaber Al-Mubarak, in 2017.

Sarawak Report was the first to expose how that money from Kuwait had been laundered by Jho Low into the Sheikh’s accounts from backhanders paid to Chinese construction companies in return for Najib’s inflation of the contract for the East Coast Railway Link.

Ghanim Saad, described by Liessner as ‘a business partner he had known for a few years’, was (perhaps not surprisingly) already part of Jho’s circle as the personal advisor to one of the members of 1MDB’s so-called Advisory Board, Sheikh Hamad bin Jassim bin Jaber Al Thani. (The Advisory Board never actually met).

The Century bank deal fell through because the Mauritian regulators rejected the money as being suspicious. Subsequently, Al Mouniratyen instead sent 145 million euros to Leissner’s own company Midas Commodities, some $49 million of which he used to help Jho Low pay pressing 1MDB debt repayments, but most of which he put into his own pocket to buy the above cited Beverley Hills mansion, a $15 million yacht, shares in his wife’s Baby Phat clothing brand and 3.9 million Celsius shares for $3 million. Those shares then proceeded to rocket in value.

Later, Sarawak Report detailed how the cash from Al Mouniratyen was stolen from Malaysia. Further funds had been funnelled from bogus pipe line contracts set up by Najib in Malaysia in 2017. RM8.3 billion (about US$2 billion) was paid upfront to the Chinese contractor CPPB, representing 88% of the total value of the project, even though only 13% of the work was ever done.

Tim Leissner has admitted that all the cash he obtained from Al Mouniratyen into Midas was most likely Malaysian loot, although he has attempted to also suggest that the nominal owner of Al Mouniratyen, the jailed Sheikh Sabah who ‘lent’ Midas the €145 million, is somehow the person to whom he owes the money, rather than Malaysia. This was how he answered questioning by Roger Ng’s lawyer in March 2023:

Q: And your suspicion is that that house in Beverly Hills was Low’s money?

[Leissner]: Yes.

Q: Because you had no reason to think that Sheikh Sabah would give you a dime, do you?

A: Yes. There was no other business contact with him.

Q: And the FBI and the Department of Justice, they let you live in that mansion after your arrest, right?

A: Yes, I lived there.

Q: They let you keep the mansion, right?

A: They haven’t forfeited that mansion.

Q: They didn’t forfeit it, right? As you sit here today, it’s still not forfeited, right?

A: That’s correct……..By the way, that money is to be repaid is my understanding

Q: To be repaid to who and when?

A: The agree — well, to the sheikh.

Q To the sheikh? So you think the sheikh is waiting on this money from you?

A: There was an arbitration request for that money yes….

Q: Do you have any intention to pay the Sheikh that money?

A: It can only be done when those assets are sold and two as the resolution worked with my lawyers with any of these matters I talked about here….”

Following the conviction of Roger Ng, Leissner agreed to pay a $43 million fine for his part in the crime. It appears that this was deducted from the ensuing sale of the Celsius shares by the DOJ following his conviction in November 2025.

But, what do these transfers tell us about the real ownership of the other assets under Midas, including the $25 million mansion in Beverley Hills that Leissner had continued to live in as of 2023?

Mysterious Share Transfer Raises Questions

The mysterious changes of ownership of the Celsius shares lie at the heart of the questions over Leissner’s stolen cash and concerns that Malaysia’s interests are being sidelined in favour of an indulgent settlement for a devious whistleblower, who only sang after being arrested.

The pre-trial release bond for Leissner was set by a New York Judge on June 14, 2018 for the amount of $20,000,000, to be secured by 3,972,659 shares of Celsius stock that was claimed at the time to be held at JP Morgan Chase Bank account in the name of Leissner’s wife Kimora Lee Simmonds.

This bearing in mind that all of Leissner’s assets, including these shares which had previously been held by Midas, had been registered as ‘sold’ to Newland the month before.

Yet, it seems the circle was eventually squared regarding the phantom bail bond. Kimora Lee Simmons would later state in her own court testimony, during later squabbles over who was due what, that “On July 11, 2018, 3,972,659 shares of Celsius stock were transferred to Lee’s personal brokerage account from Nu Horizons.“.

This means that in order to meet the requirement of Leissner’s agreed bailout, the shares that had been “sold” in May to Ghanam Saad’s company Newland were somehow then transferred on to Kimora’s JP Morgan account.

The DOJ would later seize 3,370,787 of those shares from the JP Morgan account March 2021 to make the forfeiture. By that time those shares were estimated as being worth over $330 million.

Are we really expected to believe that the Qatari who had supposedly purchased them (and the ownership of the Beverley Hills house and all Leissner’s other assets) for $170 million in May 2018 had surrendered them back to Kimora a couple of months later to make bail bond for Leissner?

Leissner’s testimony at the Roger Ng trial in 2022 gives an insight into what really seems to have happened, which is that the ‘sale’ to Leissner’s business pal was more a game of smoke and mirrors to attempt to further disguise his stolen assets and move the alleged ownership into an off-shore haven famous for its ‘banking secrecy’.

Under questioning he admitted he had merely transferred the ownership of his mansion and other assets from the name of his former wife to Ghanam. He had lied about this during his first interviews with the FBI but had finally cracked and admitted it during his 9th interrogation.

Indeed, the very fact he had been able to transfer the shares from the company he had ‘sold’ them to back to the ‘ownership’ of his wife in order to post his bail, was the clearest possible sign he continued to control the shares.

Likewise, Leissner admitted that while the nominal sale of the company had been cited as $170 million, the cash would only be realised once all these assets (the shares, house, yacht) were sold:

“The assets were in the United States so the assets don’t move. The ownership was transferred offshore or the intention was that the ownership was being transferred offshore. The assets themselves stay where they are”, Leissner told the court in his testimony against Roger Ng.

He went on to admit that he and his then wife Kimora had travelled to Lichtenstein after the ‘sale’ in May to look for a good location “to hold the consideration” from that purchase (in other words to disguise the continuing hidden ownership), given Lichtenstein has “a very sound system of bank secrecy”, as Leissner put it, before returning to the United States and his arrest.

Further questioning effectively confirmed that it was the ownership of the assets rather than cash that was being lodged in the Lichtenstein bank by the visiting couple, with a view to selling them later, rather than the proceeds from a genuine earlier sale of Midas:

Q “And where was that money at the moment? In other words when you and Kimora went to Liechtenstein, where was the money?

[Leissner] It was still in the assets that we talked about transferring or selling to Newland. So the money was nowhere. It was only the assets.” (pg 2308, transcript Roger Ng trial).

This means that a considerable trove of assets purchased with money stolen from 1MDB, including the $25 million Beverley Hills mansion currently occupied by Kimora Lee Simmonds should actually be returned to 1MDB, along with the proceeds of the eventual sale of the seized Celsius shares.

However, this is where the disappointment sets in for Malaysia. By the time the actual sale took place following Leissner’s eventual conviction in November 2025, the Celsius shares had fallen in value and netted only an estimated $190 million (from a peak of over $400 million at the time he surrendered them).

Minus the forfeiture, and some of the shares which Kimora and her ex-husband are claiming they bought themselves (a settlement of this dispute with the DOJ seems imminent), around $100 million ought to be remaining.

That money ought at least be returned to Malaysia. However, Sarawak Report has learned that there has been no discussion so far about sending back the cash to KL.

Even more depressing has been the apparent failure by the DOJ so far to include any further demands on the rest of the Midas stolen assets as part of Leissner’s agreement to cooperate: an agreement he had early on sought to cheat on by lying about the Newland ‘sale’.

To the contrary, it seems Leissner has been rewarded for his lies because the DOJ has continued to treat these assets as if they were outside the case.

Beverley Hills mansion ‘sale’ that went to court

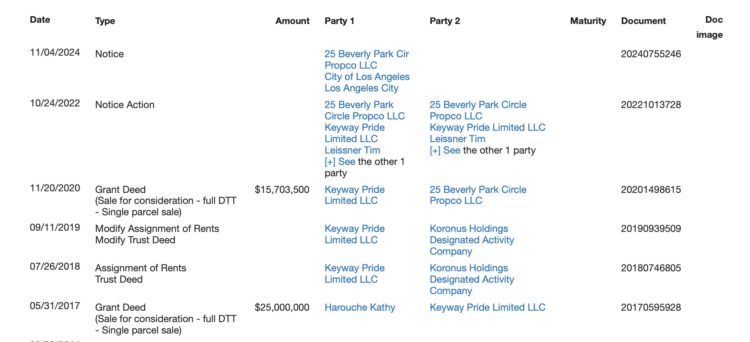

The mansion at 25 Beverley Park Circle in Beverley Hills is the most glaring example. Bought by Leissner and his then (bigamously married) spouse, the ex-model Kimora Lee Simmonds with stolen 1MDB cash in 2017 for $27 million, it is plainly an asset that ought to be confiscated with the value returning to Malaysia.

However, Leissner appears to have embarked on staggeringly devious manoeuvres to put the property (or at least its value) out of the way of confiscation – to the extent that it is now the subject of an ongoing raging ownership battle dragging through the courts.

It is a dispute that has connected Leissner to some extremely interesting names indeed, connected to 1MDB’s crooked partners in the Middle East. These include, Amanda Staveley, the former close confidante of Khadem al Qubaisi and her separate billionaire business partners the Reuben brothers for whose son Jamie she brokered the purchase of a share of Newcastle United.

The extent to which Leissner’s ex-wife Kimora Lee Simmonds collaborated in the deceit is open to claims and counter-claims pending trial. However, on the basis of having allegedly been defrauded by her ex-husband, Staveley and the Reubens, Lee Simmonds (purportedly a multi-millionaires businesswoman in her own right) has continued to live for free in the sprawling Beverley Hills Mansion …. apparently deaf to the irony that it really belongs to the people of Malaysia.

The saga detailed in the court papers is as follows. After the couple flew to Lichtenstein to conduct the bogus sale of their assets to Ghanam Saad, followed by Tim Leissner’s arrest in June 2018, they borrowed a huge sum of $12 million against the value of the mansion they had supposedly transferred to the Qatari businessman.

As the judge in the case has pointed out, “Leissner admitted to efforts to move and hide assets, including ownership of his entities like Keyway [the holding company for the property], out of apparent concern the U.S. government would seek to disgorge the Property as restitution.” (Roger Ng case).

Lee Simmonds’ own depositions appear to confirm that she was aware and consented to this first transaction to raise money out of the value of the house.

Coming to the rescue to broker the deal was none other than the businesswoman Amanda Staveley, former friend of the by then imprisoned al Qubaisi and recognised as being also close to his former boss Sheikh Mansour, Chairman of IPIC/Aabar and brother of the Crown Prince (now President) of the UAE, Mohammed bin Zayed al Nahyen (MBZ).

The connection to the 1MDB network is therefore clear. Indeed, Najib is on record threatening MBZ that his brother was highly exposed by the scandal, not least because he had received $160 million towards his yacht out of the half billion dollars received by al Qubaisi in kickbacks from Jho Low.

Staveley had prevailed on her contacts, the Reuben brothers, to stump up the $12 million loan, which they provided through one of their companies, Koronus Holdings.

Why these top businessmen would agree to offer a loan on a controversially acquired property to a charged fraudster begs several questions. Perhaps they were helping out their network of Middle Eastern contacts by taking some of the pressure off the Goldman banker who knew so much?

The Leissners were supposed to pay interest on this loan taken out in July 2018; however, it appears they never did. By the following year an embarrassed Amanda Staveley apparently ended up paying what was due out of her own pocket through an amendment to the terms of the loan.

By late 2020 with over two million dollars by then outstanding and still no payments from Keyway Pride (under which the couple still claimed title to the house), a new arrangement was arrived at whereby Leissner signed off on a sale of the property to another company owned by the the Reubens named 25 Beverley Hills Circle Propco LLC [Propco] for a hugely diminished $15 million (minus the money outstanding to Staveley who made sure she got paid off in the process).

Leissner then signed a separate contract whereby he agreed on behalf of the same Keyway Pride company that had sold the property (itself 100% owned by Midas which he plainly still controlled) to rent back the property for the princely sum of $67,000 a month.

These payments were due to begin in May 2021 under the terms of the contract. However, true to earlier form, the by now apparently warring couple never paid a bean. Indeed, by January Kimora had filed a legal action against her husband, Staveley and the Reubens brothers for having allegedly conducted the sale and leaseback arrangements behind her back. That case has been raging through the civil courts ever since that date.

The legal arguments have been waged around whether Leissner had the right to sign off the house from the supposedly jointly owned Keyway Pride without Kimora’s consent. Her lawyers have claimed he forged a document to give Propco (the Reubens) and Staveley’s legal teams the excuse to say they understood he had the right to sign off a sale on his sole signature.

The plaintiffs have provided convincing evidence of such doctoring and the crook Goldman banker is known to have had previous form. After all, he has admitted to twice forging divorce papers in order to convince two successive would-be brides that he was a free man: he did it to Kimora and to his previous wife.

If the Reubens and Staveley fell for this, Kimora’s argument is they were at the very least negligent, which is her excuse for staying on in the mansion without paying one dollar for the privilege … whilst her husband has apparently vanished the total of $27 million… the original cost of the property when they bought it with Malaysian money in 2017.

The couple have therefore effectively invited Malaysia and the DOJ to fight it out with the Reuben brothers as to who owns the right to realise the value of the estate, whilst Kimora lives it up in style on the back of Malaysian loot.

As for her estranged spouse, as one analyst has concluded that given such tactics Leissner looks set to be sitting pretty after, at worst, two years’ detention in a low security faculty (he is still hopeful of a pardon):

“As a German national, Leissner will be deported from the US after serving his sentence and will be able to live a comfortable life with many 10’s of millions of dollars he stole from the Malaysian tax payers”.