A single mum can go to jail for stealing milk for her child, but the big four accountancy firms seem to have returned to a sense of impunity along with banks. Accountacy giant Deloitte today immediately pushed back over the relatively modest ‘maximum penalty‘ exacted for their part in assisting ex-PM Najib cover up the heist of the century.

The KL branch has appealed the indignity of RM2.2 million being clipped off their company bonus payments for doing such a rotten job of oversight and failed reporting that billions were stolen from the nation.

Disappointed

“Deloitte PLT respects the role of the SC to regulate and safeguard the Malaysian capital market and takes its responsibilities as an audit firm seriously. We are, however, disappointed with the decision,”

The company stated, failing to appreciate how disappointed others have been in them for failing to check if the fictional $2.3billion dollars purportedly raised from the sale of 1MDB’s shares in PetroSaudi had really been invested in a dodgy Singapore based Bridge Global Absolute Return Fund – instead of being stolen, which is what had actually happened.

To give Deloitte their due, they may feel their rival KPMG did an equally useless job, before being sacked by Najib for refusing to sign off on those accounts. After all, KPMG had approved earlier accounts that involved the backdating of the so-called Muharabah loan agreement to PetroSaudi, in order to achieve a blatant cover-up over the original joint-venture, from which $1.83 billion was filched into Jho Low companies and kickbacks.

When questioned about the matter back in 2015 KPMG’s UK head office blithly evaded responsibility, explaining that the global giant’s new structuring based out of Switzerland means that each country branch now merely represents a loose ally of the firm for which corporate HQ holds no responsibility whatsoever.

At the very same time Najib was posturing in KL, claiming the 1MDB accounts were copper-bottomed precisely because they had been audited by the ‘global accounting firm’ KPMG.

Whether KPMG will also receive a penalty for its apparent failure to spot the blatant thefts; its signing off of backdated documents and later failure to report the suspicious antics of Malaysia’s finance minister after the firm had been sacked for not signing off on the Cayman Island shennanigans is yet to be seen.

Billionaires

However, possibly even more troubling than the attitude of impunity exibited by such massive corporates is the apparent failure so far of regulators to take on the involvement of some of the world’s most powerful billionares who profitted from the thefts from 1MDB.

Just last week the global power fest at Davos was momentarily disrupted when one Dutch academic shocked those present (1,500 had arrived by private jet) by suggesting that over-powerful billionaires who fail to pay their dues are the main problem with the world economy.

If 1MDB is any kind of example to go by, such individuals, who shelter their wealth through the off-shore system and distribute largesse tactically around the world’s decision makers to protect their interests, hold more impunity even than major banks and corporations.

After all, one of the largest single investments by Jho Low of stolen 1MDB cash appears to have been in the Electrum Group, controlled by a US billionaire with strong and active involvement in Middle East politics, Thomas Kaplan.

It is noticeable that whilst Leo DiCaprio and Miranda Kerr may have handed back their Picasso and their diamonds, regulators have so far failed to exact recovery of the $150 million invested by Jho Low into Electrum during the telling period of late 2012, just after the major 1MDB thefts had taken place.

The other major investors in Electrum were none other than the Abu Dhabi sovereign wealth fund Mubadala and the Kuwait Investment Fund. These are key Middle Eastern allies of the United States, regarded as being particularly close to the present administration thanks to the allegiences of President Trump.

Mubadala has now absorbed Aabar/IPIC, the vehicle used by the 1MDB co-conspirator Khadam al Qubaisi (KAQ) to loot billions from Malaysia, and Aabar has in turn recently taken ownership of several of KAQ’s investments, including the Hakkasan nightclub chain with assets in Las Vegas and across the world.

Just last week KAQ, now imprisoned for his role in Abu Dhabi, complained to the Wall Street Journal that his assets were being wrested from him by the Aabar/IPIC boss Sheikh Mansour, who used to be his boss. KAQ declared he was being used as a ‘scapegoat’ over 1MDB.

For months Sarawak Report has enquired what investigations are taking place into the evidence that stolen 1MDB cash flowed to Hakkasan, via KAQ’s Vasco Investment Trust account in Luxembourg that was pumped with half a billion of kickbacks from Jho Low? However much went into Hakkasan, it’s due back to Malaysia.

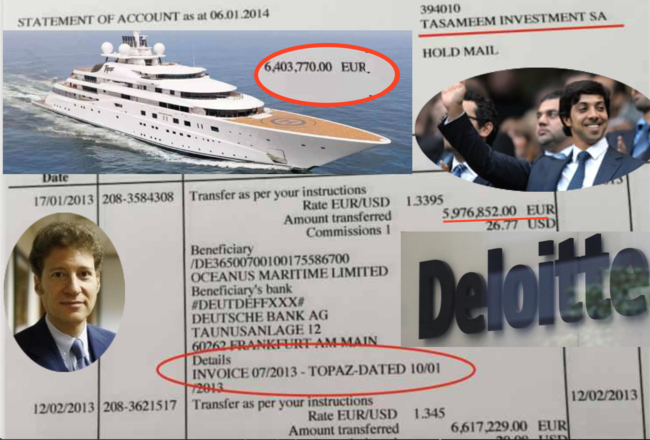

What’s more there is the small matter of the further evidence documented by this site that tens of millions were likewise transferred from KAQ’s Vasco Trust as well as Tasameem (the company through which he owned Hakkasan) towards payments for the purchase/upkeep of the world’s 5th largest yacht Topaz, widely understood to belong to Sheikh Mansour himself.

So far, there have been no demands made for the return of 1MDB money from the Abu Dhabi royal for those payments on the yacht, on which Jho Low, Leo DiCaprio and their friends stayed and partied during the Brazil World Cup, just like there has been no request to cash in shares from Electrum Group.

Is it to be concluded that these influential billionaires were unwitting by-standers, who cannot be required to return investments and massive gifts received in good faith and that the same standards to not apply to them as to banks and others?

Or are they simply too powerful and untouchable? Thomas Kaplan, who invests in metals, is active in Middle Eastern politics as a fierce critic of Iran, against whom he funds an influential campaign body United Against a Nuclear Iran (UANI). His stance allies him closely with the likes of Abu Dhabi, Saudi Arabia, Israel and President Trump in seeking a confrontational approach as opposed to earlier mediation.

As far as Malaysia is concerned this is not about power politics, but returning stolen cash. The country needs its 1MDB money back and the less arguments, excuses and delays from banks, big businesses and billionaires the better.