On 24th October 2013 a team of lawyers from the New York law firm Greenberg Traurig (‘gtlaw’) emailed the Abu Dhabi based New Zealand lawyer, Jim Sullivan, at the time a Board Member of the wealth fund IPIC and also of its subsidiary Falcon Bank.

The CEO of IPIC, of course, was Khadem Al Qubaisi (KAQ), who is currently under arrest in Abu Dhabi and the subject of extensive anti-money laundering investigations in a number of countries.

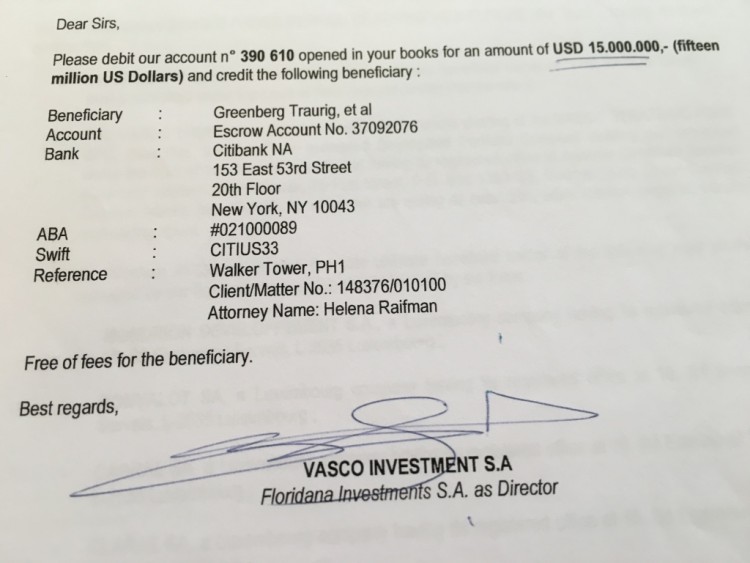

The subject of the email was the purchase of a $50 million penthouse in New York’s Walker Tower, one of the properties subject to a seizure notice by the US Department of Justice, owing to the fact that it was purchased through KAQ’s Vasco Investment Services SA (manager of his Vasco Trust in Luxembourg), which received over half a billion dollars stolen from Malaysia’s development fund 1MDB.

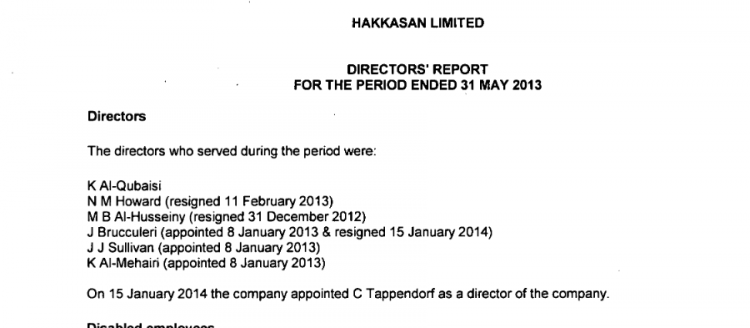

Significantly, Sullivan was emailed regarding this purchase in his further capacity as a Board Member of the private US entertainment and nightclub chain Hakkasan, which was at that very time enjoying a massive expansion of its businesses in the US, particularly in Vegas.

Addressed to “[email protected]” the email says:

“Jim, Attached for H.E.’s [His Excellency/KAQ] signatures please find execution versions of the Purchase Agreement, Rider to Purchase Agreement and Side Letter…. As discussed, please let me know when the wire for the $15,000,000 deposit has been sent to GT [Greenberg Traurig]. Below are GT’s wire instructions….”

Attached to a copy of the document obtained by Sarawak Report are indeed the contracts ready for signing by KAQ to take ownership of the Walker Tower penthouse flat. Signing off the $15 million deposit on behalf of Vasco Investments SA is the beneficial owner, Khadem himself:

The involvement of Sullivan in his capacity as a representative of Hakkasan in the purchase of his IPIC boss’s New York flat with money acquired from 1MDB is symptomatic of the close knit web of operations between KAQ related companies, which were all run by the same handful of key operators.

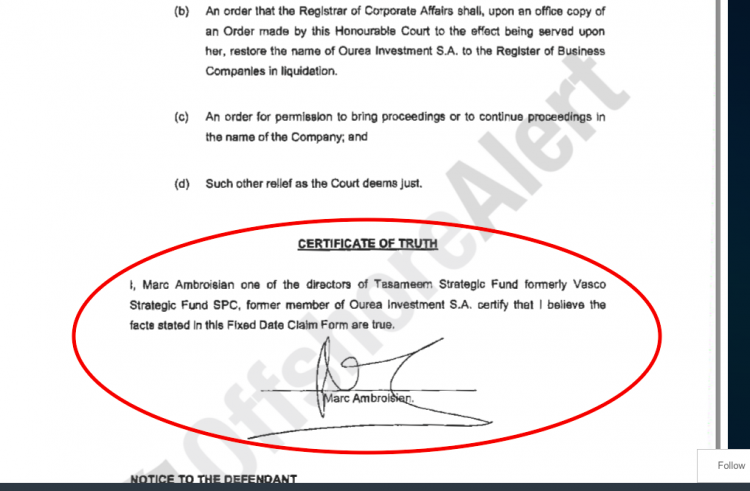

These were in particular Sullivan himself; Hakkasan’s CEO, Neil Moffitt, and Marc Ambroisien, then CEO of Edmond de Rothschild Bank in Luxembourg (BPERE), the manager who had originally agreed to accept the suspicious payments from 1MDB.

As pointed out in the DOJ court filing naming Khadem Al Qubaisi, Moffitt was also involved in the Walker Tower deal, registering himself as the manager of this and other KAQ properties:

“Moffitt manages or managed several properties on behalf of QUBAISI. On March 9, 2015, $158,664.71 was transferred from the Vasco Account to an account at J.P. Morgan Chase maintained by Moffitt. Payment details on the wire read: “WALKER TOWER COMPLETE EXPENSES ” [Section 477-9 DOJ indictment]

Moffitt has since stated that this was a perfectly acceptable arrangement and he has insisted that any involvement by himself in the now frozen properties does not mean that the Hakkasan Group received any money from the same sources, ie the Vasco Trust Group of companies.

He has widely threatened to sue any media that suggests otherwise.

“Hakkasan claims none of the money came from illegal funds, and their VP of Legal Affairs Brandon Roos, who had previously sent this publication threatening emails, claims that their own “internal investigation” proves it.” (Pace Vegas)

How Edmond de Rothschild Bank proved KAQ’s ownership

Hakkasan lawyers have also on occasion denied that either KAQ or the company Tasameem own Hakkasan and they have indicated that all their investment came instead from a separate sovereign wealth fund in Abu Dhabi, suggested to be none other than IPIC’s Aabar.

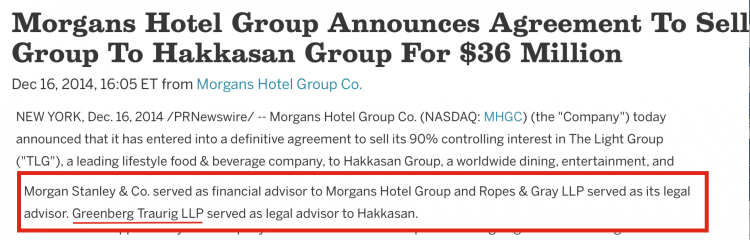

Yet not only were the roles of key directors in Hakkasan clearly intermingled with the distribution of KAQ’s ill-gotten 1MDB money, the entertainment group also availed itself of the same company of lawyers when conducting its expansion within the United States during the same period:

None of this was coincidence, as Sarawak Report can now demonstrate, because we have obtained further documents, including bank statements and structural diagrams provided by BPERE which contradict the claims by Hakkasan that there was no overlap between the companies.

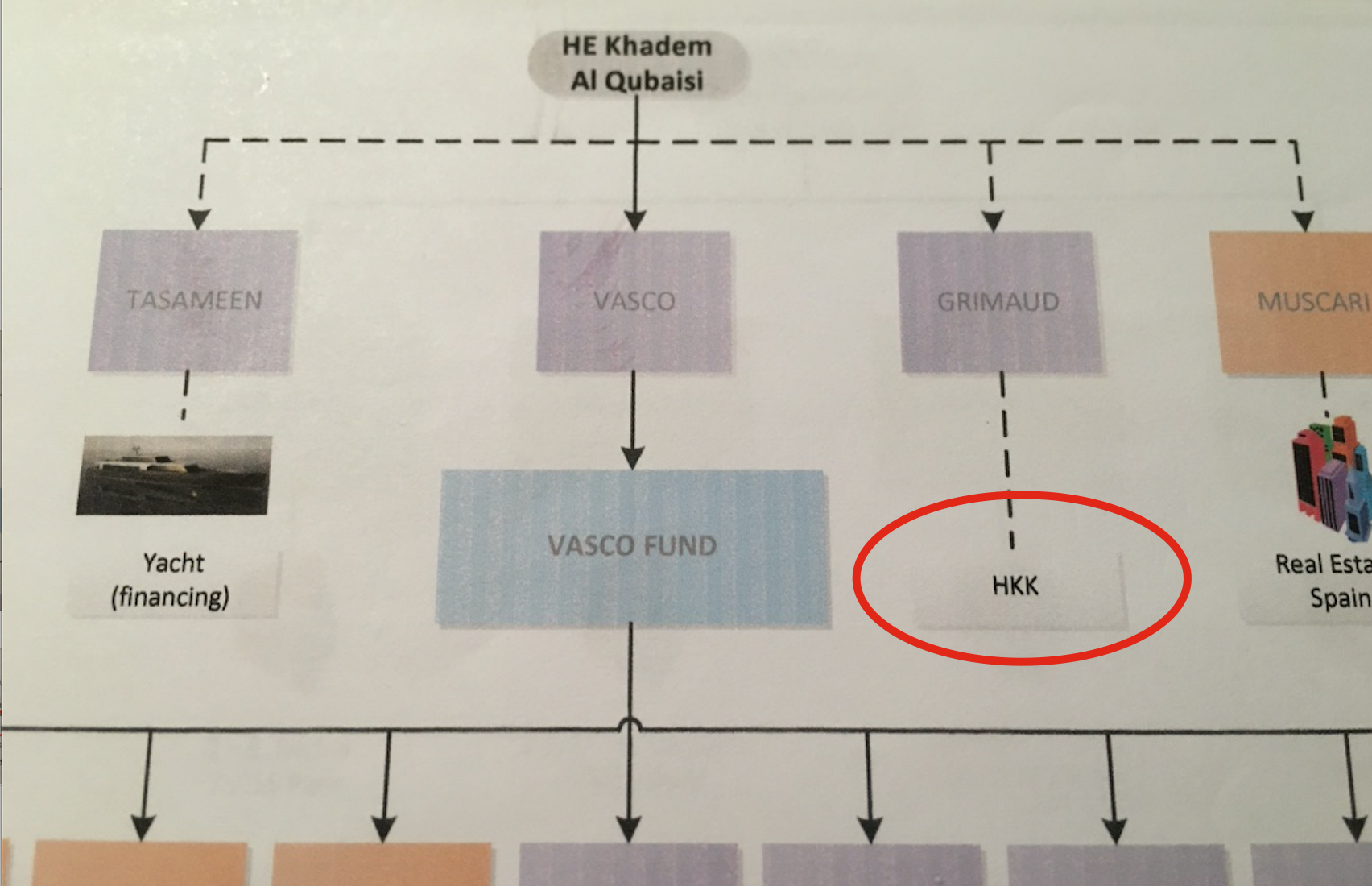

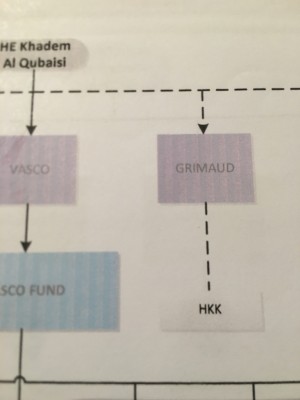

Vasco & Tasameem are part of the same web of KAQ companies as ‘HKK’

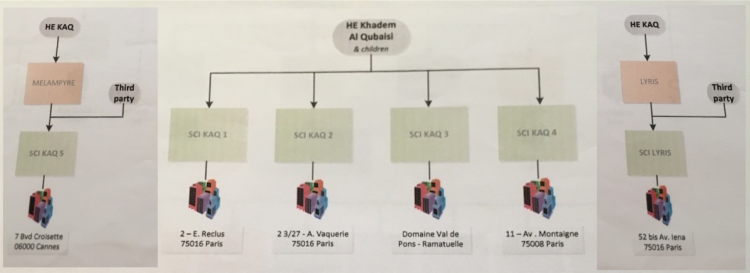

These papers show that the nightclub company formed a major part of KAQ’s Vasco-related investments

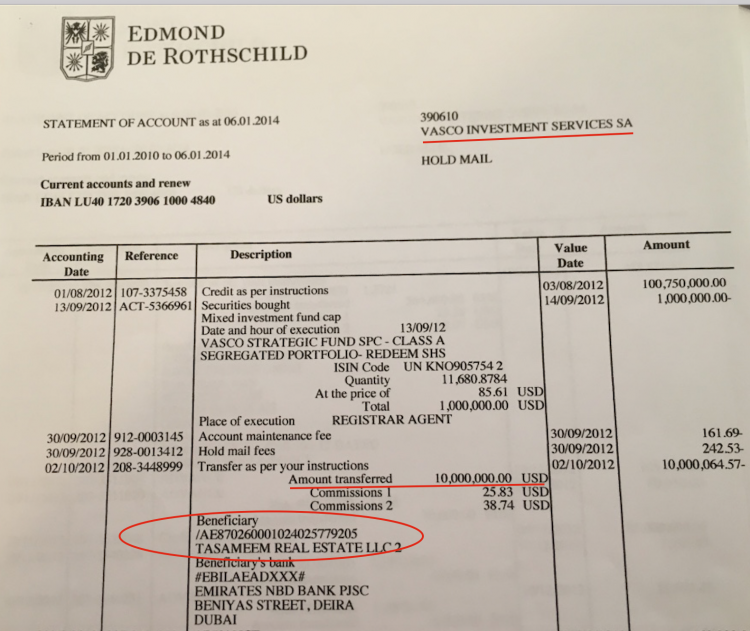

And they further prove that in late 2012, at the time Hakkasan was being launched in the US, at least $10 million dollars was directly paid by the tainted Vasco Investments SA to the named corporate shareholder of Hakkasan, Tasameem Real Estate Company LLC.

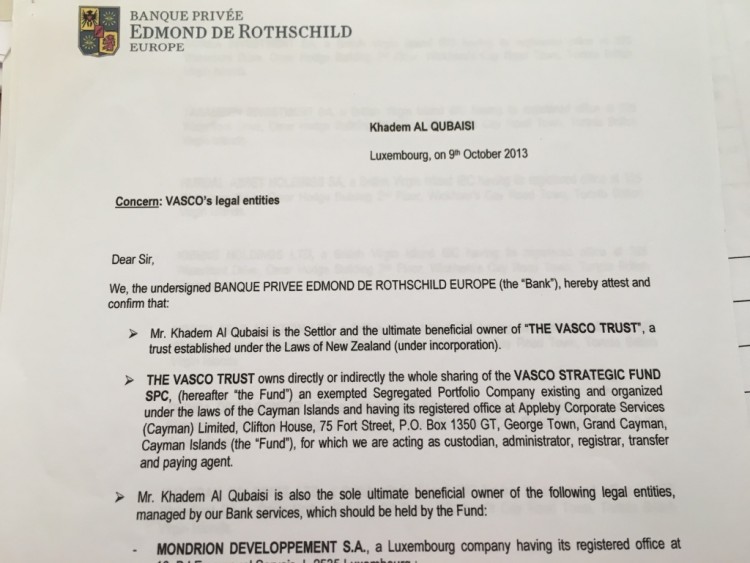

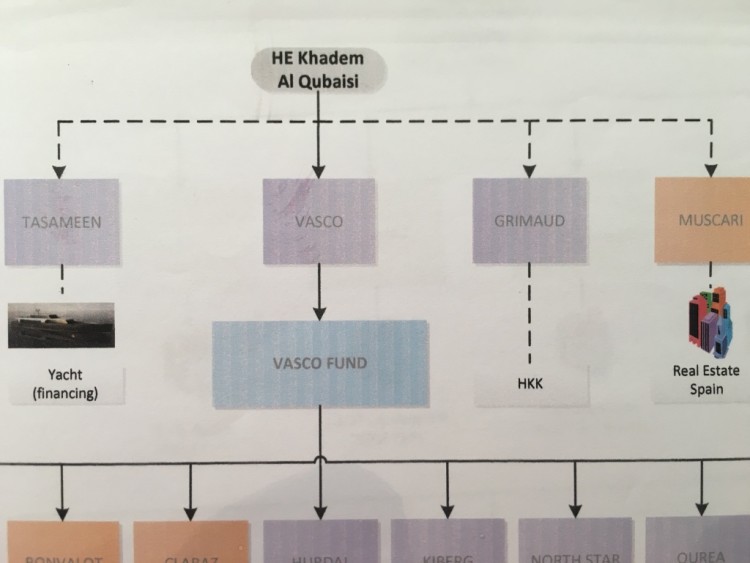

The Vasco and Tasameem Groups of companies, according to this information from BPERE, were all owned by KAQ in 2013 and were linked in a complex web with clear transfers of cash between them.

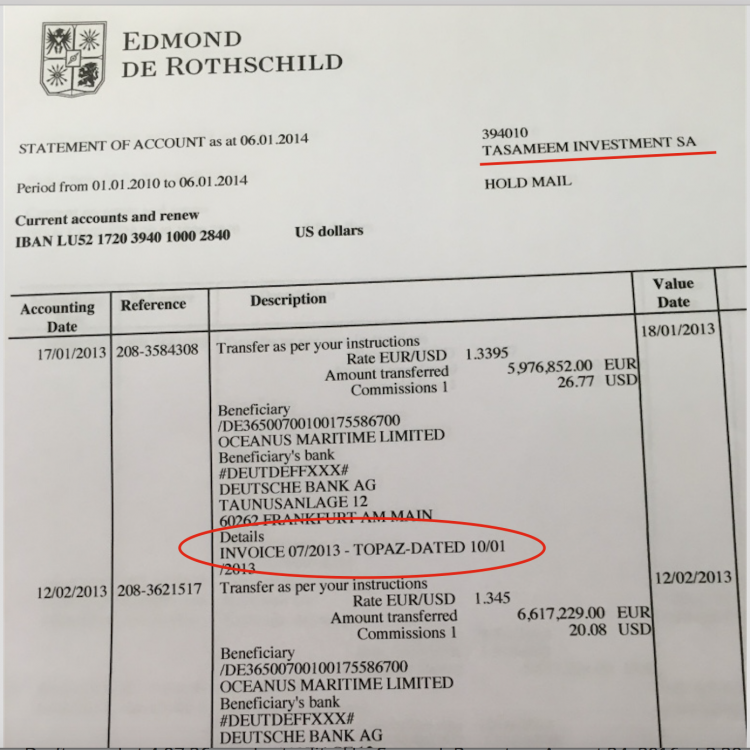

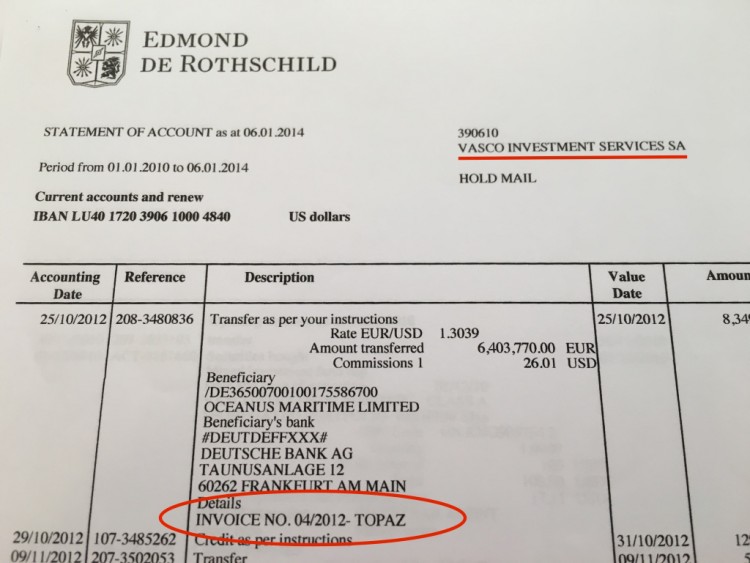

Tellingly the Vasco and Tasameem companies also shared the same roles. For example, bank statements show that both Vasco Investment Services SA and Tasameem Investment SA were involved in the financing of one of the world’s largest super-yachts, Topaz.

The structure of this group of companies was confirmed in a letter (above) sent 9th October 2013 by BPERE to KAQ with an accompanying diagram listing the various entities and their relationships.

The letter made clear KAQ’s ownerships included a subsidiary Vasco Strategic Fund SPC, which Sarawak Report has already demonstrated was later renamed Tasameem Strategic Fund – a clear link to the corporate shareholder of Hakkasan, Tasameem Real Estate Company LLC, which was also owned by KAQ, who remained Chairman of Hakkasan until he resigned on April 29th.

A diagram of this web of companies, also provided by the bank, shows how Khadem Al Qubaisi topped a network of parallel concerns, including Tasameem (labelled with the function of “yacht financing”), Vasco and also the owner of HKK, a vehicle named Grimaud.

Under the Vasco Fund (fuelled by 1MDB), were a line up of companies controlling real estate in Spain and Morocco, a Formula One racing team in Italy, two aircraft and a string of properties in France.

Yacht financing

The yacht financed by Tasameem, according to bank statements viewed by Sarawak Report, is the 5th largest in the world, Topaz.

It is regarded as being owned by KAQ’s boss at IPIC, Sheikh Mansour, however KAQ was financing payment every month to the tune of over $7 million, paid to the builder Oceanus Maritime Limited.

Significantly, however, not all the payments for the yacht were made from the company Tasameem Investment SA.

Some were directly handled by none other than Vasco Investment Services, the management company for the trust which received half a billion from Jho Low’s Blackstone Asia Real Estate Partners from 1MDB.

So, although Hakkasan’s Neil Moffitt has said his ‘internal review’ has proved there was no link between 1MDB’s flow of money to Vasco Trust and the corporate shareholder of Hakkasan, Tasameem Real Estate Company, these entities appeared to be interchangeable from KAQ’s point of view when it came, for example, to the financing of his yacht.

We have even shown how he changed the names of a key subsidiary from Vasco Strategic Fund SPC to Tasameem Strategic Fund:

Was it just a question of diverting money from where it was available at the time to target different projects from the point of view of this single owner? This would certainly appear to be the case.

More Questions for the Luxembourg investigation of Rothschild Bank

Likewise, Khadem’s key assistants also appear to have held interchangeable roles, including BPERE’s CEO Marc Ambroisien and the IPIC/Falcon Bank/Hakkasan Board Member Jim Sullivan, who were available to work on different sections of this sprawling empire.

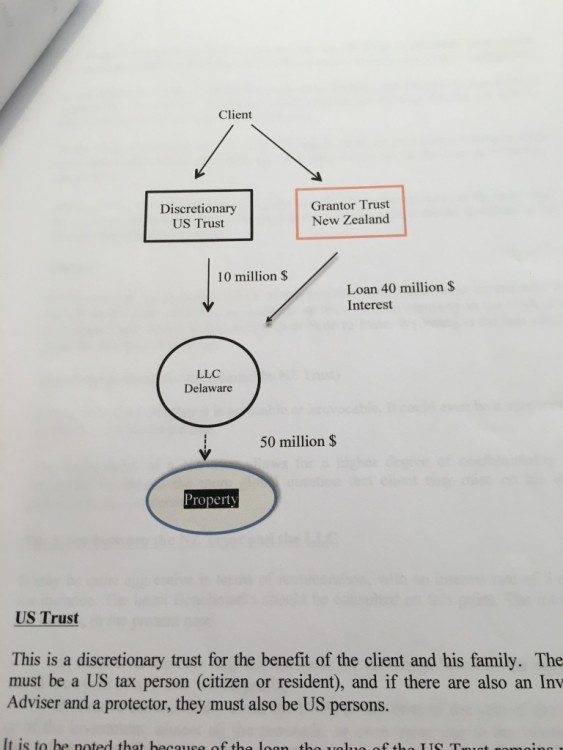

Indeed, the documents futher show how BPERE’s bankers worked together with French tax lawyer Philippe Delattre from Degroux-Brugere to give extensive and detailed support and advice to KAQ on how to set up a complex off-shore structure, in order to disguise the extent of his financing of the $50 million Walker Tower flat.

Most of the cash injection should be dressed up as an outside ‘loan’ from a separate foreign entitity, counselled these trust experts, in order to lower the value of the US investment as much as possible and to avoid tax on any gains.

The French lawyer even advised KAQ to charge himself “a quite aggressive renumeration” for the bogus loan “with an interest rate of 7 or 8% for instance”. That way he would reduce any capital gains tax on a resale.

KAQ’s ruse provides further insight into how the off-shore system of companies (and secretive on-shore states like Delaware) assist the mega-rich in hiding the often criminal sources of their wealth, while at the same time avoiding the taxes which the less well-off are forced to pay.

The French lawyer suggested New Zealand as a good place to locate the bogus “grantor trust” because of “a higher degree of confidentiality” available. It is therefore of little surprise that several firms belonging to the family of KAQ’s 1MDB co-conspirator, Jho Low, are also located in New Zealand.

When will France take action against King Khadem of St Tropez?

The KAQ group of companies, managed by BPERE’s former CEO Marc Ambriosian until just a few days ago, also includes numerous top properties in Paris and St Tropez, where KAQ’s bespoke sports cars are often seen lined up in fleets outside.

Sarawak Report therefore asks when will France announce that it is also investigating possible laundering of money from 1MDB?

Vasco Investment Services paid $10 million to Hakkasan shareholder Tasameem Real Estate Company LLC

As if all this evidence were not sufficient to prove that Hakkasan and its corporate shareholder Tasameem Real Estate Company are by no means ring-fenced from the stolen sources of 1MDB entering Vasco Trust, Sarawak Report has obtained yet further documents which show that a direct payment was made of at least $10 million in 2012 from Vasco to none other than Tasameem Real Estate Investment LLC.

Trail from 1MDB to Hakkasan shareholder

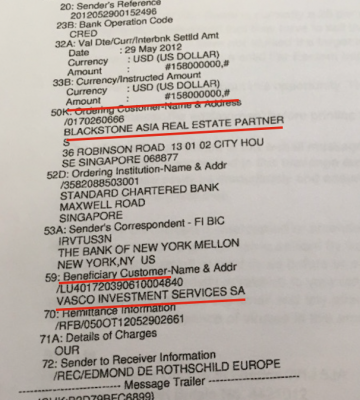

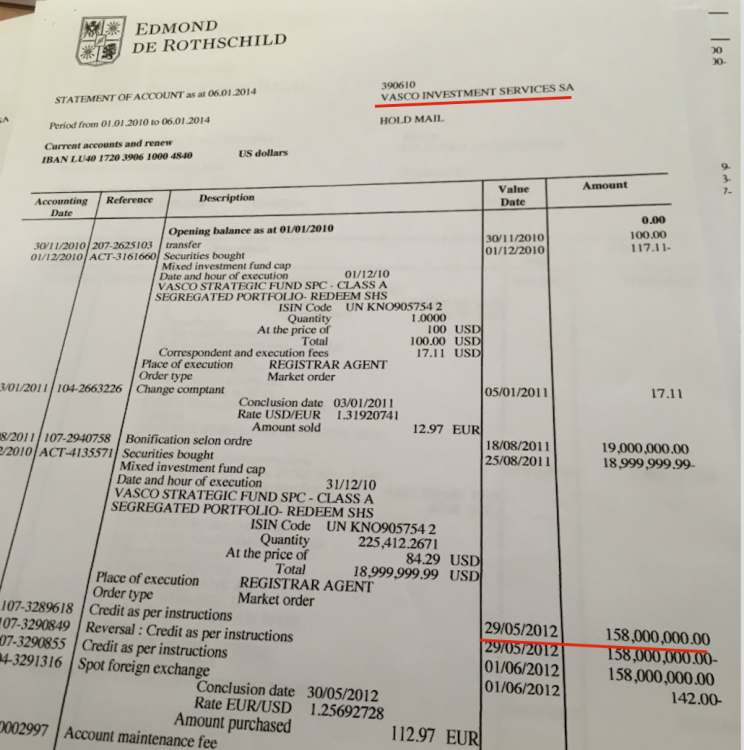

The money trail begins with transfer documents showing how 1MDB’s stolen money was paid by Blackstone Asia Real Estate Partners and other Jho Low controlled companies into the account of Vasco Investment Services SA, part of the Vasco Trust.

Bank statements available to the FBI and Luxembourg authorities further confirm the cash flow. For example a payment of $158,000,000 made from Blackstone Asia Real Estate Partners to Vasco Investment Services on 29th May 2012:

That money was sent just days after KAQ’s company Aabar Investements PJS BVI had assisted Jho Low in diverting $577 million from 1MDB’s first power purchase loan of $1.75 billion raised by Goldman Sachs, according to the DOJ:

“Between approximately May 29, 2012, and November 30, 2012, four wires totalling $472,750,000 were sent from the Blackstone Account to an account at Bank Privee Edmond de Rothschild (“Bank Rothschild”) in Luxembourg maintained in the name of Vasco Investments Services SA (“Vasco Account”). Vasco Investments Services SA is a BVI entity affiliated with QUBAISI, and QUBAISI is the beneficial owner of the Vasco Account. QUBAISI used a portion of the $472,250,000 transferred into the Vasco Account from Blackstone to acquire real property in the United States worth roughly $100 million, [Section 181-3 DOJ court filing]

That leaves $372,000,000 of the Blackstone money still unaccounted for by the DOJ investigators, plus other 1MDB related payments to Vasco, including from Jho Low’s Good Star Limited, raising the total to over half a billion dollars which flowed from 1MDB to Vasco Investment Services SA.

The destination of that money is still being reviewed, leaving Hakkasan very much in the frame according to the evidence. Not least because the BPERE statements also show that at least one $10 million dollar payment was later made in October 2012 from Vasco Investment Services SA direct to Tasameem Real Estate LLC, the Shareholder of Hakkasan.

In total the Hakkasan accounts filed in the UK show that Tasameem as shareholder has altogether passed on a total of $566 million to the company in ‘shareholder loans’ since the rapid expansion of the nightclub chain began in Vegas in late 2012.

How could Hakkasan cash be ring-fenced from Vasco’s 1MDB money which was flowing into the same group of companies owned by the same shareholder – especially when payments of millions of dollars were being transferred from Vasco to Tasameem Real Estate Company?

Recent reports in the United States have in fact confirmed that the DOJ investigations into the origins of Hakkasan’s cash investments are on-going, despite the denials of Neil Moffitt.

Witnesses are still being questioned on these matters, Sarawak Report has also learnt.

And there is clearly plenty more evidence to be obtained from the Luxembourg and DOJ enquiries into Edmond de Rothschild Banque Privee before investigators announce where they believe the as yet unaccounted for remaining $372,000,000 that KAQ received from 1MDB exactly went.