All last year Najib and his circle were demanding that Malaysians ‘be patient’ and wait for the findings of the Auditor General’s report into 1MDB to be completed.

When finally it was completed, twelve months later, they declared it an ‘Official Secret’!

To make their meaning as clear as possible, prominent PKR MP, Rafizi Ramli, was arrested on the steps of Parliament last week for threatening to reveal further information about Tabung Haji payments to 1MDB, which they had also handily classed as an ‘Official Secret’.

Therefore, the Parliamentary Accounts Committee report has presented a highly important remaining insight into the scandal, even though MPs were denied a great deal of crucial information with respect to what they identified as a missing US$7 billion (RM28 billion) from the fund. This is the total figure which 1MDB has invested in mysterious foreign companies, for which they have provided zero financial information either to the PAC or the Auditor General (whose report the MPs HAVE been allowed to see, but not publicise).

The missing amounts are, according to PAC member Tony Pua:

-

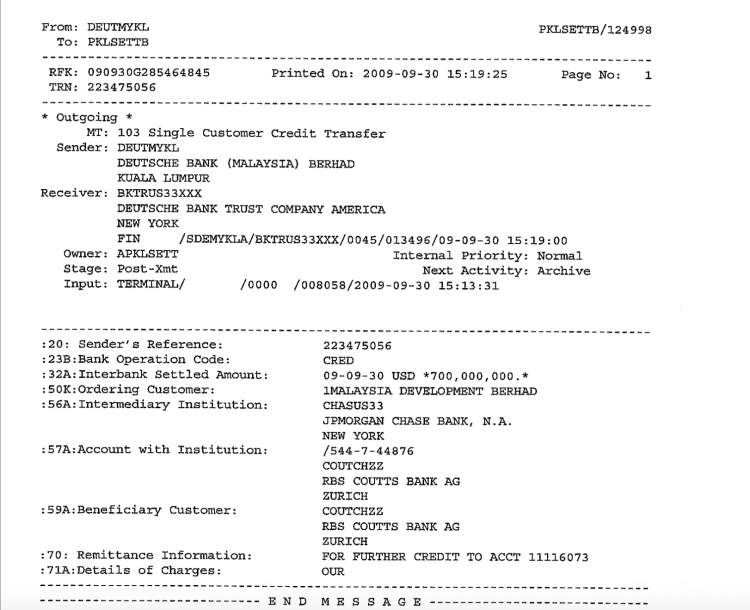

The sums of US$700 million and US$330 million, which were misappropriated to Good Star Limited, a company unrelated to the purported 1MDB-Petrosaudi joint venture in 2009 and 2011.

-

US$3.51 billion, which was paid to a British Virgin Islands (BVI) incorporated Aabar Investment PJS Limited “Aabar (BVI)” in the form of collaterals, options termination compensation and further unexplained “top-up security” payments despite obvious doubts over who owns Aabar (BVI).

-

US$940 million worth of “units” which was parked at the Swiss Bank branch of BSI Bank in Singapore.

-

another US$1.56 billion of investments by 1MDB’s wholly-owned foreign subsidiary, 1MDB Global Investments Limited, which also could not be verified by the Auditor-General.

The PAC report detailed how CEO Shahrol Halmi had shockingly defied his Board to go ahead with expensive borrowing and investments such as the PetroSaudi joint venture, which had been specifically vetoed by board resolutions pending further research – all confirmation of course of the concerns which Sarawak Report has extensively reported over the past year.

The PAC committee has therefore recommended that Halmi be criminally investigated. Furthermore, it has made another crucial set of recommendations, which require the dismantling of an unusual clause governing 1MDB, namely Section 117 – also the abolition of the company’s so-called Advisory Council.

Section 117

The significance of the PAC demand for the removal of the provisions of Section 117 has so far been downplayed, particularly by Najib’s supporters, who have suggested that the report totally exonerated Najib and “proved” he had no responsibility for the disastrous decisions of 1MDB. This could not be further from the truth.

The clause, according to the evidence of the committee, was introduced into the articles governing 1MDB in September 2009, at the time when it was officially converted from its original title and purpose as the Terengganu Investment Authority and re-named 1MDB.

Section 117 transferred total power over the newly fashioned 1MDB into the hands of the Minister of Finance, who is named as the sole shareholder and signatory of the company. Furthermore, it goes so far as to specifically forbid the normal representation of officials from the Ministry of Finance to sit on the Board of the company, even though it was supposed to be a 100% subsidiary of this department of state.

There could be only one reason for this extraordinary ban against Finance and Treasury officials from participation in the running of 1MDB, and that is that the new Minister in charge (i.e. the sole shareholder and signatory/ the PM himself) wanted to be free of any oversight or interference from departmental experts regarding his decisions over the fund.

This extraordinary provision applies to only one other company controlled by the Ministry of Finance, Sarawak Report has been informed. And that company is none other than SRC International, which is the other scandal hit enterprise, which Najib also set up under 1MDB and then financed with RM4 billion borrowed from the KWAP pension fund – money that has also been almost totally unaccounted for.

Finance Department officials have confirmed that as a result they had no oversight whatsoever over these companies, which were supposedly public concerns controlled by their department, and which had moreover raised billions in loans that were guaranteed by the Malaysian Government, thanks to letters of commitment signed by the Minister of Finance.

It is really terribly shocking.

Dazzling with ‘big names’

In a clear attempt to side-step concerns about these unusual provisions under Section 117, the Prime Minister/ Finance Minister set up a third tier of ‘governance’ for the company, which was supposed to act as a counter-balance to this deliberate lack of oversight.

This was the so-called Advisory Board of which he was the self-appointed Chairman.

The names on this Advisory Board, consisted of a dazzling array of international bigwigs, with the seeming purpose of over-awing potential critics into silence – they were all Najib’s best political and business contacts from around the world (France’s richest businessman, Berhard Arnhalt; The remarkably wealthy Prime Minister of Qatar; the Head of Mubadala in Abu Dhabi, amongst others).

Who would dare to call into question such a star line up of heavy-weights, all putting their guidance and expertise into the management of Malaysia’s great investment enterprise? It appears nobody in Malaysia indeed did so. Except, the PAC report confirmed, this committee of luminaries has never once met!

Only its Chairman, Najib, was therefore in place to give orders, determine investments, sign documents and make decisions. He had clearly set the whole structure up this way, in order to deliberately to sidestep the normal checks and controls of company management, thereby enabling himself to assume total dictatorial control over the way the billions raised by this fund were spent.

One wonders why?

The consequences of this approach can be very clearly seen, according to the investigations reported by the PAC. Shahrol Halmi, who had been recruited from the accountancy firm Accenture to head up the fund, when it was originally pulled together by Jho Low on behalf of his friend Najib, knew exactly who was the real boss.

Indeed, when the original Board representing Terengganu (who had put up its future oil revenues as the collateral for lending) protested at reckless and expensive borrowing proposals, Shahrol Halmi just ignored their orders and went ahead without board permission to borrow RM5 billion from AmBank.

That RM5 billion will have cost Malaysia a staggering RM15 billion in total costs by the time it is finally paid back, says the PAC report. And most of that money was channelled into the company Good Star Limited, which the PAC have now confirmed had nothing whatsoever to do with 1MDB’s joint ventures.

Orders from Najib over-ruled 1MDB Board, thanks to Sec 117

The PAC reports the excuse that Halmi gave them when questioned about this jaw dropping defiance by a Chief Executive against his own Board. He referred to Section 117, which he explained to PAC members over-ruled the authority of the Board:

“The Public Accounts Committee (PAC) found Mr Shahrol to be in violation of the shareholders [decision] not to proceed with publication IMTNs. Mr Shahrol also made a mistake by signing the agreement without any power conferred by the board of directors.

The PAC was informed by Mr Shahrol, he did not follow orders to stop the issuance of RM5 billion Islamic Medium Term Notes and bonds did not follow the instructions of the Board as the power actually lies with the shareholders in accordance with Section 117 of the Articles of TIA Berhad. [Google Translation of PAC report]

There is only one way to interpret this explanation, given that Najib Razak is the only shareholder of the company.

What Halmi was saying was that, under the provisions of this Section 117, he had obeyed the higher authority of the sole shareholder and signatory of the company, rather than the Board.

It means that although the 1MDB Board had told Halmi to halt the plans to borrow RM5 billion, given the ridiculous rates, Najib, the grand new Finance Minister/Prime Minister in charge of the fund, had counter-manded him to take no notice and go ahead anyway.

Halmi, in accordance with the rules of the company, had obeyed the boss who had also recruited him, namely Najib.

There is no other way to interpret Halmi’s reference to Section 117 as his reason for defying the Board, not just on this occasion but on numerous other occasions with respect to the PetroSaudi joint venture in 2009. For example, he refused to halt the deal until a proper valuation of PetroSaudi was obtained, as had been requested, and he refused to send the money back when Board members discovered USE$700 million had been sent to Good Star Limited, which was unrelated to the Joint Venture.

This is all very clearly spelt out in the report by the PAC and so makes a mockery of attempts to claim that it did not hold the Finance Minister cum Prime Minister totally accountable for this fraud, which was launched just weeks after he had stepped into his new position of power in April 2009.

Interestingly, Halmi was in fact back-dating the existence of these provisions in the articles of 1MDB at the time he made these excuses to the PAC in 2015, because Section 117 was not added to the company’s articles of association until the change-over from its status as the Terengganu fund to 1MDB in September of 2009 – just days before the signing of the PetroSaudi deal, but weeks after Halmi had defied his original Board by borrowing all that money!

Never mind, it just goes to show the naked truth about the way that 1MDB was conceived and run by Najib and his side-kick Jho Low from the very start. Halmi knew who he was supposed to take his orders from and to hell with the letter of the law – in Malaysia, where the PM had total control such matters could be fixed.

According to reports, Halmi is still telling people that Najib is ‘unshakable’, so he considers himself ‘safe’.

Kings and State to State Partnerships

The technique of ‘fixing’ things by asserting power and grandeur under-pinned the entire strategy of 1MDB. The PAC has analysed this Jho Low-constructed bluff (already exposed by Sarawak Report).

In short, 1MDB did not just do investment deals, it engaged with powerful and impressive friendly states in ‘government to government’ diplomacy (supposedly), making any questioning or criticism of Najib’s actions appear – well churlish and unpatriotic!

Thus the PetroSaudi deal was described to the 1MDB Board as a crucial state to state venture with none other than the Kingdom of Saudi Arabia. Manager Casey Tan even briefed the Board that the PetroSaudi had been set up in 2000 and personally belonged to King Abdullah.

This was a total lie, just as managers had previously lied that the Abu Dhabi Mubadala fund was investing in Iskandar in May 2009 (which was immediately denied) and later in 2013 lied that Abu Dhabi’s Aabar was investing in a ‘strategic partnership’ in Kuala Lumpur’s so-called Tun Razak Exchange (which remains unbuilt).

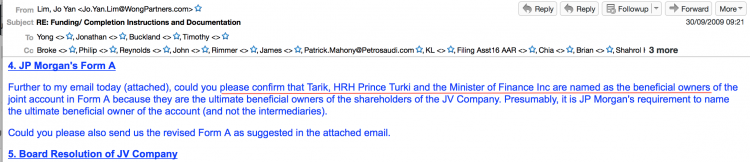

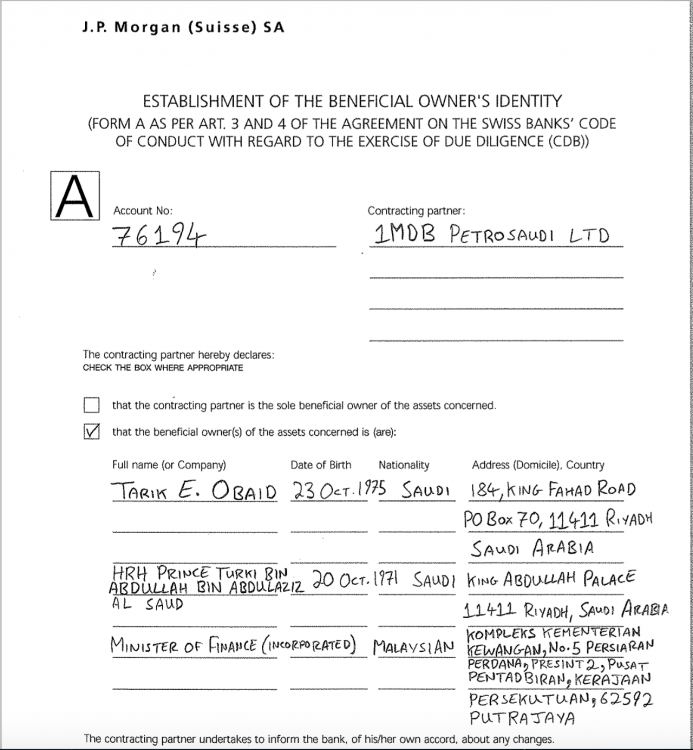

Emails obtained by Sarawak Report, sent between 1MDB’s lawyers Wong & Partners and PetroSaudi’s legal team at the time, make totally clear who the beneficial owners and decision makers were on each side of this deal, since the correct details needed to be given to the banks receiving the money:

The Form A sent to JP Morgan about beneficial ownership of the Joint Venture presents solid confirmation:

As PAC member Tony Pua, who has seen the secret Auditor General’s Report, has put it:

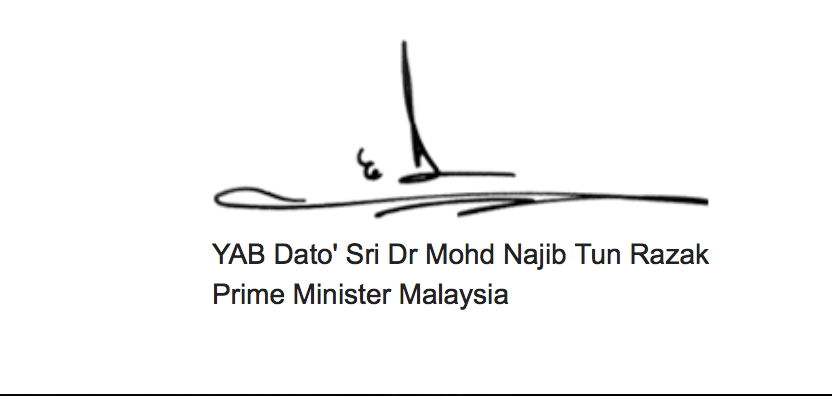

Dato’ Seri Najib Razak’s signatures are littered all over 1MDB as he was the ultimate decision maker who signed off resolutions to sack 1MDB’s auditors, Ernst & Young and KPMG, to invest US$1.83 billion in the failed Petrosaudi joint venture, to borrow US$6.5 billion of bonds via Goldman Sachs and to overpay for the RM12.1 billion of power assets.

So, what is all this bluff and bluster about the PAC report letting the PM off the hook?Because if Najib had not signed every single transaction of 1MDB, then none of the above could have happened under the rules of the company itself.

No foreign bank statements!

There is a final damning aspect to the evidence of the PAC, which is matched, the report says, by the findings of the Auditor General. This is the persistent refusal of 1MDB to produce any statements or evidence whatsoever to account for the expenditures of those foreign companies and accounts into which so much of 1MDB’s public money was placed (i.e. US$7 billion).

There can only be one conclusion as to why Arul Kanda spent and entire year pretending he didn’t understand the following simple question: ‘Please show us the bank statements’.

The obvious answer was that he simply does not have them. And the reason he does not have them is that 1MDB’s money had been deliberately siphoned out through these companies to third parties entirely – they were nothing to do with 1MDB!

This was the reason why Kanda, in his early days in the job last year was forced to fax a forged copy of a bank statement for Brazen Sky account in Singapore to BSI bank, which was supposedly holding a billion dollars for 1MDB.

Kanda asked the bank if the statement was true and (according to a letter from Singapore investigators obtained and published by Sarawak Report) the bank was forced to reply that the information was wrong. Kanda did not have the correct bank statements!

Likewise, Good Star Limited, which received US$700 million of 1MDB’s original billion ‘investment’, belongs to Jho Low, according to extensive research by Sarawak Report, which Jho Low has never contested.

1MDB has no idea what happened to money sent abroad

For this reason the PAC report specifically condemns 1MDB and Shahrol Halmi, who persisted in claiming that Good Star Limited belonged to PetroSaudi, but were never able to produce any documentary evidence that it did.

Neither could 1MDB produce any evidence that the company Aabar Investments PJS Limited (BVI) was linked to the Aabar sovereign wealth fund in later ‘joint ventures’, where than US$3.51 billion was paid in return for a for a loan guarantee of just US$3.5 billion!

What kind of a finance manager was Najib to sign off on a deal like that? What could have possessed him? Could he have ever been allowed to do such a thing if any of his tiresome apparatchiks from the Finance Ministry been looking over his shoulder?

Of course, last week The Wall Street Journal published the telling information that no less than US$150 million went from this Aabar Investments PJS (BVI) went straight to the movie production company belonging to Najib’s step-son Riza Aziz in Hollywood.

Now this is one thing (at last) that does start to make perfect sense!

Add to that the remarks of the Swiss head of the Financial Investigation Agency FINMA at the end of last week. He said:

“we are talking here not about small fry, but what looks like blatant and massive corruption….suspicious cash flows linked to the Malaysian sovereign fund 1MDB. FINMA has carried out investigations into more than 20 banks in connection with these cases, and has opened seven enforcement proceedings … we are not dealing here with shades of grey. The evidence points to clear cases of corruption.” [Mark Branson]

At which point, who in Malaysia can give a shred of credence to the claims by such fellows as Tengku Adnan, Umno secretary-general, that the PAC Report has “proved” that the Prime Minister had nothing to do with the decisions at 1MDB or that he has been some way “slandered”?

And who can believe pathetic ‘Sirul’ Halmi’s sad insistence that nothing wrong or illegal ever happened at 1MDB?

As even Najib’s inner circle are now being quoted saying “someone is going to have to go inside for this”. No one is taking bets on that someone not being being ‘Sirul’ Halmi!