The Prime Minister’s Office’s key blog of the moment, The Rakyat Post, sought to put all concerns to rest yesterday over 1MDB.

It reported that the Prime Minister had “cleared” Jho Low and was able to “explain” to the public that “all decisions and dealings of 1MDB was done by the management and board of directors”.

It leaves the Malaysian public wondering why the Prime Minister has at the same time called an enquiry to look into the considerable body of evidence that has already been published, which shows the exact opposite?

And it also leaves people wondering what is the point of an enquiry when the outcome has already been thus announced by the person who commissioned it?

After all, the Cabinet was also proclaimed by the Prime Minister’s Press Office as having “cleared” 1MDB of all possible short-comings, although this announcement was subsequently clarified by the Deputy Prime Minister, who has made it apparent that he wants a proper investigation.

KUALA LUMPUR, March 16, 2015:

Prime Minister Datuk Seri Najib Razak has cleared Malaysian businessman Low Taek Jho of any connection with investment firm 1Malaysia Development Berhad (1MDB).

“Mr Low Taek Jho has never worked for 1MDB and all decisions and dealings of 1MDB was done by the management and board of directors,” Najib explained. [Rakyat Post – organ of the Prime Minister’s Office’s cyber unit run by Arif Shah and Paul Stadlen]

More emails

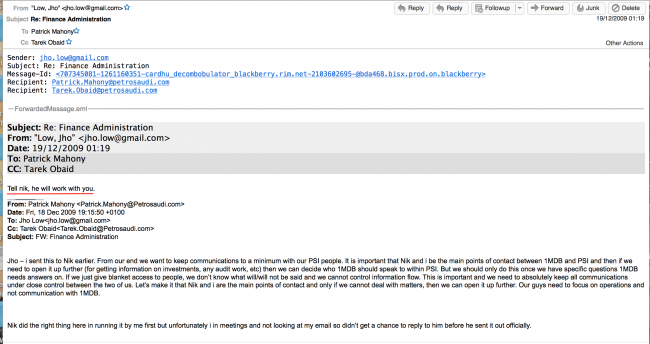

Sarawak Report has been examining the email correspondence between Jho Low with his counterparts at PetroSaudi and other partners of 1MDB.

And it all points to the fact that this youthful operator was exercising a tight control over the executives of the so-called development fund.

Take for example the following interchanges between PetroSaudi boss Patrick Mahony and Nik Faisal Ariff Kamil, the UBG bank stooge within 1MDB.

Nik had attempted to include his new 1MDB colleagues into his correspondence with Mahony and the Chairman of PetroSaudi, Rick Haythornewaite, as the first accounts for 1MDB were being prepared.

Without adequate warning it seems, he cheerfully introduced the PetroSaudi bosses to 1MDB Chief Finance Officer, Radhi Mohamed, to prepare for the questions by the auditors KPMG:

From: [email protected] [mailto:[email protected]] [Nik Faisal]

Sent: Friday, 18 December, 2009 3:27 PM

To: Patrick Mahony

Subject: Finance AdministrationPatrick,

Sending this out soon as requested by Radhi

cc shshrol, casey, you, rick, tarek, radhi

Is it ok?=========================

Dear Patrick & Rick

I’d like to introduce Radhi Mohamed our CFO to you. As we get down to the nuts and bolts of the JV Co, Radhi will be proactively involved and I trust Rick is the main man where contact will be established. We will be facing our interim audit soon and a list of information required comprising statutory documentation and financial statements of our JV Company and subsidiaries would be sent out for the purpose to prepare for our auditors. I hope Rick and Radhi can link up soon and progress this matter further.

Best Regards

However, Mahony, immediately protested to his key contact, Jho Low.

The message he conveyed was that he did not want to deal with the wider team at 1MDB and he did not want people form 1MDB dealing with the wider team at PetroSaudi either – and that included the boss Sharol Halmi, who should be kept out of the loop, as well as his own colleagues and chairman Rick Haythornwaite.

Instead, he insisted that all contact be kept under “close control” between him only and Nik Faisal, who was the key executive at UBG bank who had been put into 1MDB by Jho Low.

Otherwise, he pointed out they would not be able to “control information flow”.

Sender: [email protected]

Subject: Re: Finance Administration Message-Id:

Recipient: [email protected]

Recipient: [email protected]

Fully agreed re below.

_____

From: Patrick Mahony <[email protected]>

Date: Fri, 18 Dec 2009 19:15:50 0100

To: Jho Low<[email protected]>

Cc: Tarek Obaid<[email protected]>

Subject: FW: Finance Administration

Jho – i sent this to Nik earlier. From our end we want to keep communications to a minimum with our PSI people. It is important that Nik and i be the main points of contact between 1MDB and PSI and then if we need to open it up further (for getting information on investments, any audit work, etc) then we can decide who 1MDB should speak to within PSI. But we should only do this once we have specific questions 1MDB needs answers on. If we just give blanket access to people, we don’t know what will/will not be said and we cannot control information flow. This is important and we need to absolutely keep all communications under close control between the two of us. Let’s make it that Nik and i are the main points of contact and only if we cannot deal with matters, then we can open it up further. Our guys need to focus on operations and not communication with 1MDB.

Nik did the right thing here in running it by me first but unfortunately i in meetings and not looking at my email so didn’t get a chance to reply to him before he sent it out officially.

Thanks

From: Patrick Mahony

Sent: Friday, 18 December, 2009 6:58 PM

To: ‘[email protected]’ [NIK FAISAL]

Subject: RE: Finance Administration

Hadn’t seen this before you sent it. I just replied to all on the email you sent. Just have any 1MDB people go through me first before they touch base with PSI people. It is better that way and easier to control. I will then direct people accordingly. I think we want to keep official communications to a minimal and have everything run through you and me as much as possible. If the two of us cannot take care of it, then we let others deal with it directly but for specific matters. Let’s not open up dialogue uncontrolled between 1MDB and PS people – this is important. I want to keep the PS people focused on ops and only me and tarek should be the main people to talk to 1MDB people, starting with me. Thanks

At the end of the email trail Jho Low confirmed his understanding by telling Mahony to “tell Nik, because he will work with you”:

Meanwhile, in a separate email trail, Mahony was squaring the situation with other team members at 1MDB and telling them how “things worked” in terms of communications with

PetroSaudi, including the nervous CEO Sharol Halmi, who was worried about compliance issues.

Principally, PSI Rick Haythonewaite was to be kept uninformed.

Tarek Obaid, the other Director of PetroSaudi chipped in to complain that 1MDB’s Chief Finance Officer kept “asking the same stupid questions”.

Suitably cowed the said Radhi Mohamed thanked the PetroSaudi team for the “brief overview” of the Joint Venture into which 1MDB had invested $1 billion dollars.

Then Jho Low again capped discussions to reassure that a senior 1MDB executive Casey Tan had sojen to his colleagues to inform them only he and Nik were “allowed” to communicate with Mahony.

He confirmed CEO Shahrol Halmi had “already signed the transfer instructions”, so matters were out of his hands.

Halmi was nervous as he was being given a hard time by some members of the board and the compliance guys and just needed to cover himself explained Jho:

Sender: [email protected]

Subject: Re: Finance Administration

Message-Id:[email protected]

Recipient: [email protected]

Call me pls

On 20/12/2009 14:32, “Low, Jho” <[email protected]> wrote:

I think this was an old email. Casey has had a mtg with them and ONLY casey and nik is allowed to communicate with Patrick.I believe casey has called patrick and sorted out shahrol’s concerns. Shahrol has already signed the transfer instructions and given to casey, so patrick can liase directly with casey and nik.Thank you. Sorry for the delay but shahrol was very nervous as some of the compliance guys and board members giving him hard time so he just needs to cover himself, but agreed some of the questions are stupid and they shld have done it much earlier.Casey will shoot out fax today as I was told patrick will also email him. Thanks.

From: Tarek Obaid <[email protected]>

Date: Sun, 20 Dec 2009 13:49:10 0100

To: Patrick Mahony<[email protected]>; Low, Jho<[email protected]>

Subject: FW: Finance Administration

Is this a joke?

Why is this guy still asking the same stupid questions Patrick already answered?

—— Forwarded Message

From: Radhi Mohamad <[email protected]>

Date: Sun, 20 Dec 2009 08:49:59 0100

To: Patrick Mahony <[email protected]>

Cc: Shahrol Halmi <[email protected]>, Casey Tang <[email protected]>, Tarek Obaid <[email protected]>, Nik Faisal Ariff Kamil <[email protected]>

Subject: Re: Finance Administration

Dear Patrick,

Thanks for the brief overview on the JV Co and its subsidiaries.

Appreciate if you could advise us on the ownership of PSI Cayman,s budget and the internal control of funds at operational levels.

Rgds

RM

————————–

Sent using BlackBerry _____

From: Patrick Mahony <[email protected]>

To: Radhi Mohamad

Cc: Shahrol Halmi; Casey Tang; Tarek Obaid <[email protected]>; Nik Faisal Ariff Kamil

Sent: Sat Dec 19 21:03:10 2009

Subject: RE: Finance Administration

Radhi,

I just wanted to explain to you how the PetroSaudi team works as it relates to the 1MDB PSI JV. The JV has four directors, Shahrol, Casey, Tarek and myself. For any matters related to the JV, Tarek and myself are the only PSI people that have any involvement with the JV. So any queries related to the JV should only be addressed to Tarek and myself.

Rick is responsible for all of the operations below the JV, which start at PSI Cayman. This is where the whole team is that manages the operations and this is the main holding company for all of the PetroSaudi investments. We want to keep Rick and the team only focused on operations so do not want them involved in the JV at all. The JV is where the funds are managed and these are shareholder matters that Rick and the team should not be privy to. The funding and investment decisions at the JV level should only stay with Tarek and myself from the PSI side.

In answer to your question below, the JV does not have any auditors yet. All four of the directors know this well as we have not chosen any yet. This is something we will do at our next board meeting (currently scheduled for the 28th but will likely be moved into January as this is not a very convenient date). Also the financials of the JV are pretty straightforward. It has received $300m and the $300m is still there – though we are currently looking to move funds now to fund working capital requirements of PSI Cayman (and the companies below) as well as various new investments that are being proposed by the shareholders of the JV.

I hope this is clear. We will get auditors in at the JV eventually but currently, the situation is quite simple as the JV is just a bank account for the time being and we can all track the movements of that cash easily (all four directors control that bank account). In the mean time, please direct any queries to me that you have on any of this and we will prepare answers accordingly. Please do not send any queries to Rick as we want to keep them focused on operational matters. Tarek and I will focus on shareholder matters.

Many thanks.

Patrick

From: Radhi Mohamad [mailto:[email protected]]

Sent: Saturday, 19 December, 2009 1:38 AM

To: Patrick Mahony

Cc: Shahrol Halmi; Casey Tang; Tarek Obaid; Nik Faisal Ariff Kamil; Rick Haythornthwaite

Subject: RE: Finance Administration

Hi Patrick,

Glad to be able to connect with you . I’ll definitely contact you for any inquiries on the JV Co.

As mentioned by Nik, we are currently undergoing an interim audit exercise by our external auditors, as such we appreciate if you could forward us the latest financial statements of the JV Co.

Rgds

RM

From: Patrick Mahony [mailto:[email protected]]

Sent: Saturday, 19 December, 2009 1:48 AM

To: Nik Faisal Ariff Kamil; Rick Haythornthwaite

Cc: Shahrol Halmi; Casey Tang; Radhi Mohamad; Tarek Obaid

Subject: RE: Finance Administration

Nik,

I should be the main point person for this. Radhi – please go through me with any queries and i can direct you accordingly within the PetroSaudi team.

Many thanks.

Best,

Patrick

From: Nik Faisal Ariff Kamil [mailto:[email protected]]

Sent: Friday, 18 December, 2009 3:42 PM

To: Patrick Mahony; Rick Haythornthwaite

Cc: Shahrol Halmi; Casey Tang; Radhi Mohamad; Tarek Obaid

Subject: Finance Administration

Dear Patrick & Rick

I’d like to introduce Radhi Mohamed our CFO to you. As we get down to the nuts and bolts of the JV Co, Radhi will be proactively involved to source for information and I trust Rick is the main man where contact will be established. We will be facing our interim audit soon and a list of information required comprising statutory documentation and financial statements of our JV Company and subsidiaries would be sent out for the purpose to prepare for our auditors. I hope Rick and Radhi can link up soon and progress this matter further.

Best Regards

Nik Faisal

—— End of Forwarded Message

There is a significant confirmation in the above email exchange. Mahony makes clear that only $300 million of the $1billion had gone into the joint venture and as of December 2009 there appeared to have been found no particular use for the money.

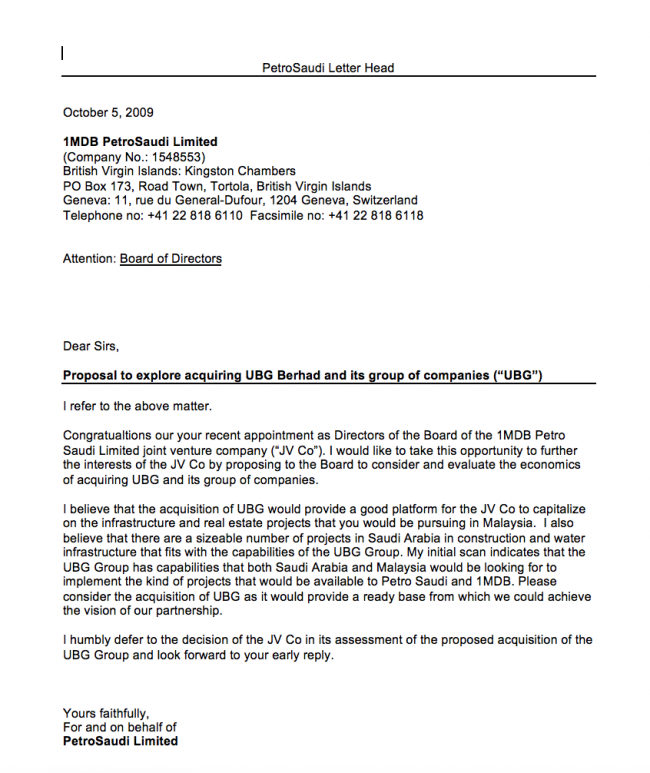

UBG proposal for 1MDB Joint Venture

Under such circumstances it seems strange that the Prime Minister/ Finance Minister/ Chairman of the Advisory Board of 1MDB has been able to “explain” that Jho Low had nothing to do with the fund and that all dealings and decisions were made by the board and managers.

Because, clearly the managers were aware that they should do what they were told by Jho Low.

Sarawak Report has also uncovered more email evidence, which shows that far from it being out of the question that money from 1MDB went into the buy out of the Taib family’s UBG bank, this was the very suggestion that was formally proposed by PetroSaudi just days after the signing of the joint venture in 2009.

PetroSaudi had subsequently denied along with 1MDB that there was ever a plan for this joint venture public money to be used to buy out UBG.

However, the letter makes plain that tis idea was at the very top of the planned agenda of PetroSaudi, which had been brought into discussions with 1MDB just a week before the JV deal was signed.

It is inescapable therefore to note that Jho Low was a Board Member and shareholder of UBG at that time.

PetroSaudi Seychelles

There has also been considerable scope for questions, which have been met with absolute denials, about the role of PetroSaudi Seychelles in this UBG purchase, given that it was posing as a subsidiary of the main company owned by Prince Turki bin Abdullah, a son of the then King of Saudi Arabia.

Sarawak Report has pointed out that although it had a similar name to PetroSaudi International, PetroSaudi Seychelles in fact appears to have been controlled by Jho Low.

It was also located at the same mailing address as Jho Low’s company Good Star in the Seychelles, which received the bulk of the money from 1MDB’s joint venture payment ($700 million).

We have obtained a document produced by the lead lender for the UBG buy out, A M Bank, which is a record of the details of a conference call, in which the unusual nature of this Seychelles company and its anomalous relationship to the main PetroSaudi company was explained by Patrick Mahony.

It was apparently all due to Prince Turki’s Royal connections, Mahony had said, which meant that the Seychelles company was being presented as being wholly owned by Tarek Obaid and not linked at all to the main company.

It seems this explanation was accepted by the bank, even though Obaid was claiming to be a nominee for the real supposed owner of the company.

In relation to the corporate structure of PSI: It was noted that the GO Exercise is being undertaken by PSI, Seychelles which is wholly owned by Sheik Tarek Obaid (“TO”), i.e. no direct link to PSI, Saudi Arabia. Patrick shared that given the political sensitivity of PSI, Saudi Arabia (i.e. involving members of the Saudi Royal Family), transactions involving public listed companies are typically undertaken in this manner, i.e. with TO acting as the representative of PSIL for the transaction and minimising unnecessary exposure of the Royal Family to scrutiny and press.

Sender: [email protected]

Subject: Javace Sdn Bhd – Conference Call with PSIL, Javace, OCBC and AmBank

Recipient: [email protected]

Subject: Javace Sdn Bhd – Conference Call with PSIL, Javace, OCBC and AmBank

From: “Daniel Lee Soon Heng” <[email protected]

Date: 04/05/2010 20:02

To: Ong Eng Bin; Chong Lee Ying; [email protected]; Project Unicorn; [email protected]; Chun Jiet Ong; [email protected]

CC: Joanna Yu Ging Ping

Dear Patrick, Choh Hun, Chun Jiet, Eng Bin & Lee Ying,

The conference call concluded earlier this evening between the representatives of AmBank, OCBC Bank and PSIL (represented by Patrick Mahony, Geh Choh Hun & Ong Chun Jiet) refers.

For ease of reference of all participants in the call, please find below a brief recap of the issues discussed during the call (and please feel free to highlight any additional comments / issues in relation to the conference call which may have inadvertently been omitted) : –

θ Brief introduction by PSIL on the ongoing developments in the Kingdom of Saudi Arabia (“KSA”) in relation to infrastructure development plans – in the region of USD500bn over the next 5 years. These plans are part of the KSA’s ongoing efforts to diversify their economy away from O&G / Petroleum base.

θ In relation to the general plans of PSIL vis-à-vis certainty of timing & source of funding to meet the scheduled repayment / full repayment of the Facility within a period of 24 months: PSIL advised that they are already in ongoing /advanced discussions with interested parties in KSA to acquire strategic stake in the UBG Group (whether directly in PPB and/or LLCB or in a new-co, comprising a merged & streamline Construction entity). These discussions have been with the large Saudi construction groups (e.g. Saudi Binladin Group) who have expressed keen interest given the ongoing construction boom in KSA and the ability to tap on PSI to secure government related construction projects in KSA. PSIL targets for such disposal to strategic investors to take place within 6 – 12 months from the commencement of the GO Exercise.

θ In relation to the corporate structure of PSI: It was noted that the GO Exercise is being undertaken by PSI, Seychelles which is wholly owned by Sheik Tarek Obaid (“TO”), i.e. no direct link to PSI, Saudi Arabia. Patrick shared that given the political sensitivity of PSI, Saudi Arabia (i.e. involving members of the Saudi Royal Family), transactions involving public listed companies are typically undertaken in this manner, i.e. with TO acting as the representative of PSIL for the transaction and minimising unnecessary exposure of the Royal Family to scrutiny and press.

θ In relation to issue of margin of financing: PSIL’s preference would be to maintain the current proposed financing structure with debt financing amounting to RM825m. In view of the status of its ongoing discussions, PSIL is confident of securing a strategic investor wherein PSIL expects the debt to be pared-down ahead of the pre-determined repayment schedule. In addition, Patrick highlighted the recent G2G dealings between Malaysia and KSA and that the GO Exercise is seen by PSIL to be the first of many transactions in Malaysia. Accordingly, Lenders under the Facility would be expected to view the transaction as the commencement of relationship with the PSIL group with expectation of further reciprocal business going forwards.

θ In relation to potential capitalisation requirement on PPB and LLCB: Given PSIL’s confidence in its ability to secure sizeable construction projects in KSA, OCBC highlighted possibility that additional funding / capitalisation from PSIL would be required to fund at least at initial stage. However, PSIL informed that such contracts in KSA typically include advance payment / mobilisation monies and accordingly would not be expected to require additional funding for these activities in KSA.

θ In relation to PSIL tie-up with 1Malaysia Development Berhad: The PSIL-1MDB JV was unlikely to be involved directly with the GO Exercise / UBG Group. However, PSIL confirmed that intention of the JV would include investments within Malaysia.

θ Request for PSIL to procure letter of support from bankers: PSIL would be able to furnish a letter of good standing from its bankers (e.g. JP Morgan). PSIL would also procure a letter of good standing in relation to TO. However such letter of good standing would not include an indication of quantum of said bank’s dealings with PSIL given the sensitive nature of such information / privacy requirements of the Royal Family.

θ SBLC to support the transaction: PSIL were not considering obtaining a Standby Letter of Credit to support the Facility at this juncture as it envisage that given it’s on-going discussions and plans for UBG/PPB & PPCB, it would be in a position to meet the repayment & full settlement of the loan within the proposed / requested 2 year tenure.

θ Timing for completion: PSIL were agreeable to meet with credit approvers of OCBC in Singapore on their next trip to Asia (mid May) [Per PSIL’s request, such arrangements/meetings between all parties to be coordinated via AmBank]. However, highlighted that given PSIL’s intention / requirement to proceed with the GO Exercise once all regulatory approvals in KSA were met, OCBC’s credit approval process for the Facility may have to proceed prior to such meeting (i.e. PSIL advised that the remaining regulatory approvals were procedural in nature and all necessary paperwork had been completed, hence timing for completion of approvals could be within the coming week). As CMS had already announced the receipt of their requisite shareholders’ approval (pursuant to the EGM on 30 April 2010), completion of PSIL’s regulatory approvals could then trigger the GO exercise / crossing of CMS block of UBG shares.

The call was concluded at this juncture. However Patrick highlighted that he would be available for any further discussions if so required by the Lenders.

Best regards.

Daniel Lee

Corporate & Institutional Banking

AmInvestment Bank Berhad

Sarawak Report in fact questions whether Tarek Obaid and PetroSaudi Seychelles had anything to do with Saudi Arabia or its Prince.

Because the evidence strongly suggests that it was merely a front for using public money siphoned from 1MDB to buy out UBG, something that the government has always denied was done.